Why individuals have the right to participate in procurement under 44-FZ

Not only organizations and individual entrepreneurs, but also individuals without the formation of an individual entrepreneur take part in the auction. This is directly stated in paragraph 4 of part 1 of Art. 3 44-FZ. If a citizen has the opportunity to offer goods, work or services, he has the right to participate in procurement. 44-FZ does not establish specific rules for procurement from individuals. The main condition is to comply with the provisions of the Federal Contract System and the requirements of specific procurement documentation.

Civil legislation does not prevent individuals from engaging in business without registering as an individual entrepreneur. Illegal business activities are prohibited (Article 171 of the Criminal Code of the Russian Federation). This means that it is impossible to engage in business without registration and licensing, if these conditions are mandatory. Violators who cause major damage and earn more than 2,250,000 rubles from illegal activities face administrative liability (a fine of up to 300,000 rubles or in the amount of income for a period of up to 2 years, compulsory work for up to 480 hours or arrest for up to 6 months).

Keep track of changes in procurement with the help of ConsultantPlus!

Set up an individual profile and receive messages about news and amendments as soon as they appear in the system. And expert explanations and comparisons of legal regulations will help you understand the confusing wording and understand the new rules. Try it for free!

Get free access to ConsultantPlus materials for 2 days

Which purchases do individuals not participate in?

Some purchases are not available to individuals. Such a supplier will not be able to submit a bid for the following orders:

- If the auction is only for small businesses. An individual is not a self-employed entrepreneur and has no right to take part in the auction. The customer will refuse the individual without consideration.

- If the customer has established a licensing requirement. A citizen does not receive a business license, which means he cannot participate in such tenders.

- If a supplier from among the members of a self-regulatory organization (SRO) is required to perform work and provide services. A similar situation is that citizens do not become members of SROs.

When an activity does not require licensing and registration of an individual entrepreneur, a citizen has the right to participate in procurement on his own behalf and offer goods, work and services.

How is such a purchase made?

There are no special rules for processing order documents in the case of admission of individuals. The customer lists in the procurement documentation and notice the documents that he requires from suppliers and attaches the recommended application form for participation in the procurement.

Individuals do not have statutory or registration documents, they only have personal registers. They demonstrate to the customer:

- FULL NAME. and registration and residence addresses instead of the name of the supplier and its legal and actual address;

- passport (copy of all 20 pages) instead of an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs;

- TIN is not a mandatory document for citizens (only for organizations and individual entrepreneurs).

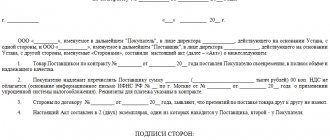

There are no other features or restrictions. An individual participant fills out an application, makes a price offer and participates in the auction. When transferring GWS, a special procurement act is drawn up: this is a special document that is used to formalize the delivery and acceptance of goods, works and services between the customer organization and the individual supplier.

Difficulties arise with the execution of the contract. There are a number of provisions that are mandatory for agreements under 44-FZ between individuals and legal entities:

- Citizens receiving income are required to pay income tax: 13% for residents and 30% for non-residents. The tax agent is the customer organization. We include in the contract a condition to reduce the amount transferred to an individual for goods, work, and services supplied by the amount of personal income tax (Part 13, Article 34 of 44-FZ). If such a clause is not agreed upon with the supplier, the contract is automatically invalidated.

- The situation is similar with insurance premiums. The tax agent is required to transfer 22% to compulsory pension insurance, 5.1% to compulsory medical insurance, and 2.9% to the Social Insurance Fund. All these amounts are deducted from the contract price. The customer is recommended to specify this condition in advance - even at the stage of drawing up procurement documentation.

- Agreements concluded with an individual as the only supplier are drawn up without indicating that the customer acts as a tax agent (Part 15, Article 34 of 44-FZ). The inclusion of this condition is not a violation. The customer will become a violator if he does not transfer the required amount of taxes and contributions.

IMPORTANT!

Contracts with individuals are not taken into account when calculating the volume of purchases for SMEs, since individuals are not small businesses.

Features of filling out a procurement act in 2021

The transaction we are considering involves the transfer by a farmer of certain products to the buyer, who transfers to him a certain amount that the parties to the transaction agreed upon earlier. And the execution of a procurement act confirms that both parties (buyer and seller) have fulfilled their obligations to each other.

ARTICLE RECOMMENDED FOR YOU:

Load test report for racks

Thus, the act is not only a document confirming the transaction, but also a kind of receipt from the seller, in which he indicates the amount received by him. This item is in the form described above, and if the act is drawn up in free form, this information must be written down by hand.

We remind you that when drawing up a document, you need to indicate only real information. For example, an understatement by the compiler of the actual cost of a product will most likely be regarded by the legislator (employees of regulatory authorities) as an illegal action (money laundering).

If, however, mistakes are made when drawing up the document, the experienced lawyers of the Legal Ambulance website recommend starting to draw up a new act!

And although the legislator does not impose any strict requirements for the execution of procurement acts in 2021, it is very important for the compiler to adhere to the generally accepted rules established for the execution of such documents.

What to include in the contents of the procurement act

First, you need to fill out the header of the document, indicating in it the name of the organization acting as the buyer. In addition, you should indicate:

- OKUD and TIN codes;

- organizational legal form;

- as well as other important information about the company.

If a specific department is involved in the procurement, this fact must be written down in the document , and if the act is assigned a number (for example, its number in the company’s internal document flow) - it must be entered below.

Then the compiler must indicate the name of the document itself and indicate the real date and place of its preparation.

After this, we proceed to filling out the main part - the body of the document, which consists of the following points:

- complete information about the person who acts as the buyer signing the deed;

- information about the individual acting as the seller signing the document;

- general information about who is buying from whom and what exactly.

At the same time, it is especially important to describe the object of the transaction in as much detail as possible. And to enter all the data, as we mentioned earlier in the article, it is most convenient to use a table similar to the one contained in the OP-5 form.

Thus, the compiler needs to indicate not only the name of the purchased and sold product, but also the quantity, unit of measurement, unit cost, as well as the transaction amount, which must be duplicated in words under the table.

ARTICLE RECOMMENDED FOR YOU:

Act of refusal to sign a dismissal order

After this, you need to describe in detail each side of the transaction. For an individual acting as a seller, it is enough to provide passport data. And for the buyer, you need to enter the details of the registration documents.

Lawyer's Note

If the seller has a certificate that confirms the fact that he is running a subsidiary farm, these certificates must also be indicated in the act.

Also, if the so-called income tax will be withheld from the amount received by the seller, this too (its exact amount) must be indicated in the content. Remember that in cases where an individual sells his own grown products, his actual profit is not taxed!

At the end of the drafting, each of the parties to the transaction must sign (with transcripts of the signature), thus confirming the fact of the conclusion of the transaction.

The representative of the purchasing organization, after signing the act, must transfer it to the manager, who is obliged to approve/endorse the transaction and transfer the document to the accounting department for use as an estimate for writing off funds from the organization’s balance sheet.

How to fill out the act

For the procurement act, the unified form No. OP-5 is valid (established by Resolution of the State Statistics Committee No. 132 of December 25, 1998). As an alternative, a purchase agreement from an individual or another document developed by the organization is used. The form of purchase confirmation is determined by management (information of the Ministry of Finance No. PZ-10/2012).

If the customer uses an independently developed procurement act, it must be approved by a separate order and enshrined in the accounting policy (clause 4 of PBU 1/2008). Be sure to include in the document:

- its name and basic details (number, date);

- information about the customer;

- Contents of operation;

- delivery quantity;

- cost of purchased goods, works and services.

All this information is indicated in the form of the OP-5 act. Here's how to draw up a purchase act:

- Decide on a form - local or unified.

- Provide information about the customer organization - its name, INN, OKPO code.

- Enter the number and date.

- Mark the place of purchase.

- Register the parties to the transaction: the buyer (customer’s employee) and the seller.

- Reveal the contents of the operation. For this purpose, the form provides a tabular section. Enter all products (with codes if possible), indicating the exact quantity, unit of measurement, price and total cost. Next, indicate the type of transaction during the sale in the procurement act: for transactions of transfer, shipment, acquisition of goods, works, services, KVR 01 is entered (Letter of the Federal Tax Service No. SD-4-3 / [email protected] dated 09.20.2016).

- Fill out the text part. The receipt indicates the supplier’s passport details and the amount of the transaction.

The act is signed by the seller, the buyer (the one who accepted or purchased goods, work, services) and approved by the head of the customer organization. If the transaction involved cash, include in the document a block with a receipt indicating that the supplier has received the funds.

Why do you need a procurement act in 2021?

Based on the above, the procurement act, first of all, acts as confirmation of the conclusion of the transaction between the seller and the buyer. The contents of the document indicate the features and details of their agreement.

Firstly, the purchase act is needed by the organization acting as the buyer. After all, it is on its basis that the accounting staff will write off funds after the transaction is concluded and the company will register the products.

ARTICLE RECOMMENDED FOR YOU:

Act on defects in production. Form and sample 2021

Secondly, this document can act as a guarantor for both parties. Thus, in the event of a conflict, claims and litigation, the procurement act will become the main document of evidence, the contents of which can be used not only by the seller, but also by the buyer.