Payment

Tax declaration If you are late in submitting returns (VAT, tax

Individual entrepreneurs have the right to apply a simplified taxation system along with other tax regimes (Article 346.11

Who is required to report to statistical authorities? Almost all economic entities report to statistical authorities:

Are you an agent or use their services? How are transactions completed and how are invoices issued?

Since January 10, 2002, the federal law “On Environmental Protection” has been in force in Russia, one of

Those who are required to maintain accounting must prepare and submit financial statements. And that's all

When starting their own business, entrepreneurs do not always pay due attention to the issue of accounting. Someone heard that

Costs for compulsory motor liability insurance relate to other expenses for ordinary activities. Enterprises on the simplified tax system “Income

Dividends are part of the profit of a commercial organization that is distributed among its participants. If

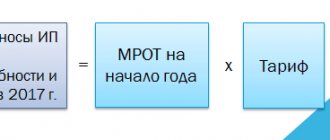

Insurance premiums refer to those payments made for their employees by individual entrepreneurs and legal entities.