Payment

In absolutely all economically developed countries, late submission of income tax reports is considered

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual.

Journal of business transactions Accounting for labor and its payment (3rd lesson). The main points that are necessary

Small and medium-sized companies in Russia are an integral part of the economy. Domestic entrepreneurs are actively developing

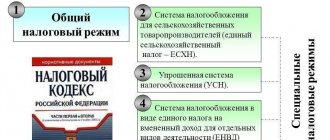

Since August 2021, it has become known for certain that such a taxation system is recognized by the state as

Who passes 2-TP (air) Who passes 2-TP (air) - legal entities and individual entrepreneurs operating in

Legal address and location: what is the difference At the “everyday” level, the legal address is

Why do you need an explanatory note to the financial statements? Preparation of annual financial statements, including

In modern society, any employee knows that failure to pay wages on time entails

Companies wishing to apply the simplified system starting next year have very little time left to submit