Payment

In the Explanatory Dictionary of the Russian Language, S. I. Ozhegov defines equipment as a set of mechanisms, machines,

On-site audit of a “simplified” person The basis for conducting an on-site tax audit, as a rule, is the need to verify

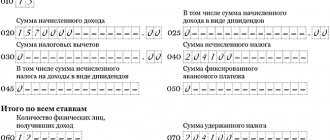

Definition 1 A tax return is a document (both written and electronic

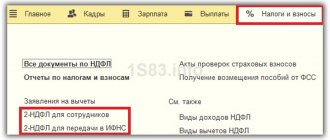

Help 2-NDFL is multifunctional and can be used at another place of work, in banks, the Federal Tax Service

STS (simplified taxation system) is a special type of tax regime that is valid throughout

Article 161 of the Tax Code of the Russian Federation states: When selling goods (works, services), the place of sale of which is

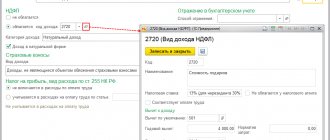

Income tax is imposed on the income of individuals received not only in cash, but also in

01/25/2016 34 550 23 Reading time: 7 min. Rating: Author: Konstantin Bely

Accounting When issuing wages with finished products or goods, make the following entries: Debit 70 Credit 90-1

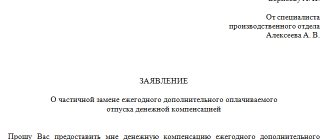

General concepts If the employee did not use the days provided for by law allotted to him for vacation, then