Payment

Accounting for income and expenses Note 1 It should be noted that by Order of the Ministry of Finance of the Russian Federation No. 116n

On July 1, 2021, Federal Law No. 86-FZ dated May 1, 2017 came into force, which

What payments are not subject to insurance contributions? Where the employer is obliged to pay them, as well as what

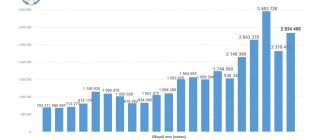

Any organization deals with certain financial flows - income and expenses. Income –

The property was received free of charge. Of course, tax authorities may suspect something is wrong and still try to attribute it to your

Settings in 1C To reflect transactions on a current account: in the Functionality settings, define additional

The procedure for paying fines The Federal Tax Service has the right to impose monetary sanctions on taxpayers for violations listed in

About how VAT can affect the price level in Uzbekistan and what is needed

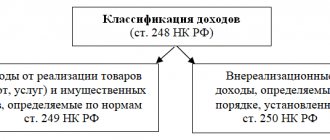

Classification of income for tax purposes Correct calculation of income tax depends on correct classification

This approach is documented in letters from the Ministry of Finance dated January 11, 2016 No. 03-03-06/40 and dated March 2, 2007 No.