Payment

In accordance with the labor code, after a certain period of time, the employer is obliged to provide paid

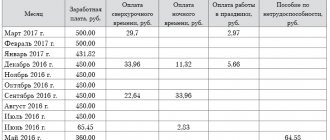

How is summarized working time accounting used? 19551 Page contents Remember, SURV stands for summarized

Home Services Zero reporting Zero reporting to the Pension Fund When an enterprise or individual entrepreneur does not conduct

Attention! The UTII regime has been canceled in 2021. All UTII payers must choose another tax

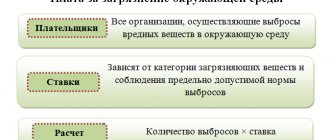

The article presents budget classification codes for paying fees for negative impact on the environment

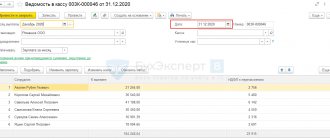

Salaries for December 2021 were paid in December. How to generate and reflect payment in

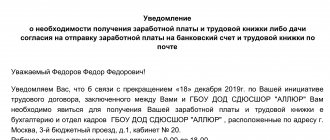

In what cases should you write? As a rule, all payments to employees of an enterprise are made through banks.

Violation of tax laws leads to fines and penalties. You can get a sanction for understating

How do non-profit organizations take fixed assets into account? The conditions under which non-profit organizations accept

Sale of real estate: different rules for calculating income in accounting and tax accounting When selling a building