Payment

How do general rules and regional specifics relate? The rules for calculating and paying transport tax are fixed

Reflection of transactions with penalty amounts in the accounting of government institutions has its own characteristics depending on

Paying taxes is one of the main points in human economic activity. Tax residence of individuals

Account 68 in accounting 68 accounting account is intended for carrying out the procedure for summarizing information

To whom and when should land tax advances be transferred to the Land budget?

Types of calculation and payment The first method - by source of payment - refers to the case

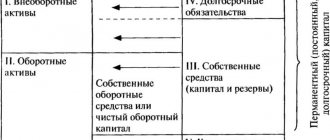

What are assets and liabilities? Assets are what generate income. Buildings, apartments,

Region codes by TIN Taxpayer Identification Number (abbr. TIN) - a digital code that streamlines accounting

A payment order (hereinafter referred to as PP) is a type of payment form documentation that is generated by the payer.

General principles for the formation of the 1st section of the form Starting with reporting for the 1st quarter of 2021