Payment

Russian legislation determines that maintaining accounting records is an obligation for all economic entities,

An online cash register is a device that issues a cash receipt and transmits sales information to

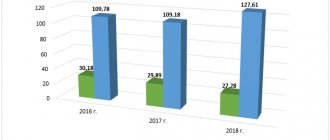

Retained earnings (loss) of the reporting year is an important indicator indicating the productivity of the company.

Accounting press and publications “Audit and Taxation”, 2005, N 5 VAT AND EXCHANGE DIFFERENCES

The stay of citizens of another state on the territory of Russia must always be legal; accordingly, all manipulations

What taxes and to what budgets do we pay? As is known in Russia, there is a three-level budget

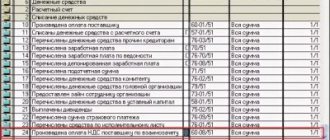

Accounting for VAT on payment and shipment in 2021 has not changed. In letter no.

There are certain real estate assets owned by persons of retirement age that are not subject to

Settlements with customers are carried out on accounting account 62. What are the features of accounting calculations

. Objective information about various processes can be obtained by systematizing, summarizing and comparing various data