Documentation

Current as of February 13, 2021 According to the rules in force today, the amount of sick leave and benefits associated

okmirs Hello. April 25, 2021 a question was asked about automatic completion of the Profit Declaration

Current as of January 30, 2021 To offset insurance premiums, penalties and fines in the Pension Fund of the Russian Federation

Deadlines for submitting form 4-FSS for 2021 Companies submit form 4-FSS to the FSS office

Russian companies and businessmen are given the opportunity to apply one of several types of special tax regimes, characteristic

What payments are due to a business traveler? The definition of a business trip is given in Art. 166 Labor Code of the Russian Federation. It is stated that

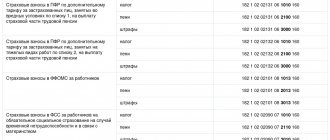

When was the last update of the BCC for insurance premiums? The last update of the BCC for insurance premiums

#4 11/14/2013 11:32:08 the total amounts must match, who told you this? Bases

The article discusses in more detail a fundamentally new form of reporting - this is calculation 6 -

When carrying out the activities of an entrepreneur or organization, there is a need for accounting. Business activity directly