Documentation

Such a certificate is submitted to the tax office by each enterprise. But she has other areas too.

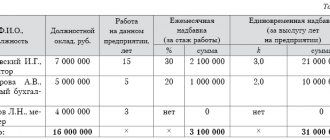

No later than April 1, 2014, tax agents* for personal income tax must report income

Civil servant length of service How to calculate Legal experience includes time periods of performing duties in

Home — Documents Express “navigator” for calculations Section 4. “Recalculations” Insurance part of the calculation Loss of rights

Author: Ivan Ivanov Form 1-NDFL is needed to record information regarding income tax and the total amount

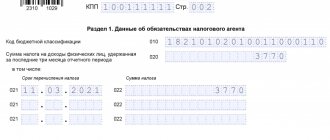

All tax agents must report in Form 6-NDFL for the 4th quarter of 2021. IN

In the 2-NDFL certificate, the tax agent must reflect the income that he pays to employees. This is the salary

Home — Articles In 2013, most organizations and individual entrepreneurs must apply tariffs

Taxation of travel expenses: general rules For an employee sent on a business trip, the employer is obliged to: 1. Pay an average

The procedure for filling out and submitting reports for entrepreneurs under the general regime is established in several chapters at once