Documentation

EXPLANATORY NOTE (FOR MOSCOW) Help Print version. Staffing number number of employees

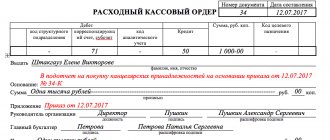

» Managing individual entrepreneurs » Cash desk In June 2014, the Central Bank of the Russian Federation (in

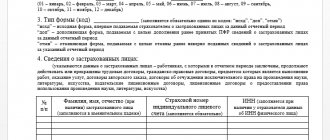

Source/official document: Resolution of the Pension Fund Board of February 1, 2016 No. 83p Where to submit: Pension Fund Frequency of submission:

Rules for calculating sick leave in 2021 Rules for calculating sick leave in 2021

Every business manager faces the task of reporting on time about his business activities and paying taxes.

Some nuances of filling out the DAM According to the DAM report in 2021, deadlines must be met

Selecting a bonus code Employers pay bonuses to employees based on their own local regulations. Cause

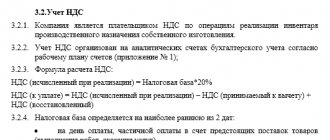

What should be in the VAT accounting policy The VAT accounting policy may include:

Form of declaration on property tax of organizations Form of declaration on property tax (form

What's new in 2021 for simplifiers Tax legislation has changed a lot in 2021,