Utility price

The Federal Tax Service often receives questions about whether VAT is charged when consumers purchase utility services . Therefore, the department drew up a letter in which it explained whether the amount of VAT is taken into account in the price of utilities.

According to paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, the following are considered the objects of taxation:

- operations for the implementation of goods, works and services in Russia,

- transfer of property rights.

Other transactions are not subject to taxes. A complete list of them is presented in Art. 149 of the Tax Code of the Russian Federation. We are interested in pp. 29, paragraph 3 of this article, according to which the sale of utilities provided by management organizations, homeowners' associations, housing cooperatives, residential complexes and other specialized consumer cooperatives is not subject to taxation.

The Federal Tax Service of the Russian Federation concludes that only those management organizations that provide utility services

Rules for the provision of utility services in 2021

59460

NTVP "Kedr - Consultant"

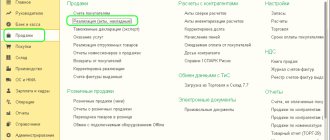

LLC "NTVP "Kedr - Consultant" » Services » Consultations on accounting and taxation » VAT » On the calculation of VAT when receiving a service from a counterparty (not a VAT payer), to a VAT payer, in the event of re-invoicing this service to a third counterparty

An enterprise that is a VAT payer has been provided with services by a counterparty that is not a VAT payer.

Question

Does the first enterprise need to charge VAT if it re-invoices this service to a third counterparty?

Expert's answer

The contract may provide that, in addition to the contract price, the buyer (customer) reimburses the supplier (performer) for the costs incurred by him. For example, costs for the delivery of goods or for travel and accommodation of the contractor’s employees sent to the customer. The amount of payment received to reimburse such costs is subject to VAT (clause 2, clause 1, article 162 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance dated November 23, 2015 N 03-07-11/67917, dated April 22, 2015 N 03-07-11 /22989, dated October 22, 2013 N 03-07-09/44156).

Having received compensation (clause 4 of article 164 of the Tax Code of the Russian Federation, clause 18 of the Rules for maintaining the sales book):

— charge VAT on the amount received at the estimated rate (10/110 or 18/118) (Letter of the Ministry of Finance dated November 23, 2015 N 03-07-11/67917);

— draw up a single copy of the invoice and register it in the sales book.

“Input” VAT on goods (work, services) purchased to fulfill a contract (i.e. for activities subject to VAT), the cost of which is reimbursed by the counterparty, is deductible in the general manner (clause 1 of Article 172 of the Tax Code of the Russian Federation, Letters Ministry of Finance dated 04/22/2015 N 03-07-11/22989, dated 10/22/2013 N 03-07-09/44156).

The buyer who has reimbursed the costs will not be able to deduct VAT on them, since he will not have an invoice. Only intermediaries - agents and commission agents purchasing goods (work, services) for the principal (committent) - can re-invoice “someone else’s” VAT.

It is better not to reimburse expenses, but to increase the contract price by their cost. For the seller, this will not entail an additional tax burden, and the buyer will be able to deduct VAT from the full cost of purchased goods (work, services), which includes the cost of reimbursable costs.

The explanation was given by Maria Pavlovna Rogozneva, accounting and taxation consultant of LLC NTVP Kedr-Consultant, in March 2021.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE ().

This consultation has passed quality control:

Reviewer: Selezneva Irina Akhmatyasavievna, Associate Professor of the Department of Accounting, Finance and Auditing, Izhevsk State Agricultural Academy

Organization of a communal complex

Utility services provided by public utility organizations are not exempt from VAT.

What is the organization of a public utility complex is explained by Federal Law No. 210-FZ of December 30, 2004. This legal entity:

- dealing with utility infrastructure systems,

- operating solid waste disposal facilities.

The organizational and legal form of a legal entity is not important, which cannot be said about the procedure for using the communal infrastructure system.

It must be used to produce goods or provide services to provide electricity, heat, water supply, drainage and wastewater treatment.

Clause 1 Art. 168 of the Tax Code of the Russian Federation determines that when selling goods, the taxpayer, in addition to the price of the goods, presents the amount of tax for payment to the buyer.

Planned changes in utility consumption standards

31780

How the cost of housing and communal services is formed

To understand the scope of services, which are regulated by law for mandatory execution by public utilities, you should know the standard list of these services. These include:

- all types of routine repairs that are aimed at maintaining the housing complex in satisfactory condition. These works are usually listed in an agreement concluded between citizens and public utilities;

- public utility services, where resource supplies are collected, and work, the implementation of which is necessary to maximize the comfort of life for citizens;

- actions performed not by utility services, but by other organizations, by agreement directly with home owners. This may include television and radio services and other analogues.

That is, the entire range of work that is associated with the management of the Moscow Railway, or the conduct of activities aimed at maintaining and repairing the current type of various common property, refers to activities regulated by law.

Based on the calculation methodology, a special commission in the region forms a tariff, which is reviewed and approved by local authorities. This tariff is then used to present payment to consumers. This tariff includes VAT when it is formed. And consumers, when preparing receipts for payment, are presented with amounts where VAT is already included.

A change in tariffs can only occur when local councils consider the issue of the irrelevance of calculations and its unprofitability. In this case, economic confirmation must be agreed upon by the administration of the NP.

Also, the CG contractor himself is not authorized to change the cost of purchased resources when delivering them to consumers and, on the basis of legislation, VAT is not charged in this case. Delivery of purchased resources to the consumer occurs at a cost that is equal to the price of their acquisition from the enterprises supplying the resources. The price already includes the specified tax.

A different approach to considering taxation in organizations of the public utilities complex. This complex is a legal entity whose focus is on public utility infrastructure. This also includes electricity suppliers and gas supply companies.

In this case, the CG complex is provided by special organizations on the basis of contractual relations. And accordingly, such organizations cannot be exempt from remitting value added tax. In this case, the organizational and legal form on the basis of which the specified legal entity operates does not make any difference.

Based on the legislation, in such organizations, when selling their services, value added duty is presented to the end consumer for payment.

VAT FOR REIMBURSEMENT OF UTILITY COSTS

(INCLUDING ELECTRICITY) UNDER THE LEASE AGREEMENT

Paying for utilities separately from the rent is the most common way in practice to reimburse the landlord's utility costs. At the same time, it causes the most controversy with officials regarding the deduction of “input” VAT amounts by both the landlord and the tenant.

TAXATION AND ACCOUNTING WITH THE LESSOR

According to the financial and tax authorities, operations involving the transfer of electricity, water, and gas from the lessor to the lessee do not relate to operations for the sale of goods for VAT purposes, since the lessor cannot act as a supplier of these goods to the lessee, since he himself acts as a buyer (subscriber). In this regard, the lessor does not have an object of VAT taxation (Letters of the Ministry of Finance of Russia dated December 31, 2008 N 03-07-11/392, dated December 26, 2008 N 03-07-05/51, Federal Tax Service of Russia dated February 4, 2010 N ShS- 22-3/ [email protected] , Federal Tax Service of Russia for Moscow dated 06/08/2009 N 16-15/58069, dated 05/21/2008 N 19-11/48675).

The courts also believe that in this case there is no implementation (the landlord does not provide utilities). Therefore, the landlord should not issue the tenant an invoice for the amount of utility services consumed by him (see, for example, Determination of the Supreme Arbitration Court of the Russian Federation dated January 29, 2008 N 18186/07).

In addition, the landlord does not have the right to reissue invoices to the tenant, since in this case he is not an intermediary between the tenant and the service provider and, therefore, is not subject to the provisions of paragraph. 5, 7 pp. “a” clause 7, para. 3.5 pp. “a” clause 11 of the Rules for maintaining a log of received and issued invoices, clause 11 of the Rules for maintaining a purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137 (hereinafter referred to as Decree N 1137).

For law enforcement practice on the question of whether a tenant can apply a deduction for utility expenses and in what order an invoice is issued, see the Encyclopedia of VAT Disputes.

At the same time, we note that even if the landlord issues an invoice to the tenant, where he indicates himself as the seller, he still will not have an object of VAT taxation. As the Federal Antimonopoly Service of the North-Western District indicated in Resolution No. A56-30790/2004 dated 09/05/2005, issuing invoices in the absence of an object of VAT taxation does not imply the sale of goods. For additional information on this issue, see also Resolution of the Federal Antimonopoly Service of the Volga Region dated April 12, 2007 N A55-14832/06.

Regarding the deduction of “input” VAT charged to the landlord by utility providers, officials explained the following.

Since the transfer of electric and thermal energy, water, gas from the lessor (subscriber) to the lessee (sub-user) is not subject to VAT, the amount of “input” VAT presented by public utilities in relation to the services consumed by the lessee is not deductible from the lessor. Based on paragraphs. 1 item 2 art. 170 of the Tax Code of the Russian Federation, the landlord must include this amount of tax in the cost of utilities consumed by the tenant (Letters of the Ministry of Finance of Russia dated 03.03.2006 N 03-04-15/52, Federal Tax Service of Russia for Moscow dated 21.05.2008 N 19-11/48675 , dated July 16, 2007 N 19-11/067415). Some arbitration courts share the same opinion (see, for example, Resolution of the Federal Antimonopoly Service of the North-Western District dated September 12, 2006 N A52-353/2006/2).

As for the registration in the purchase book of invoices presented to the landlord by service providers, the Ministry of Finance of Russia proposed registering such invoices without taking into account the tax amounts for utility bills consumed by the tenant (Letter dated 09/06/2005 N 07-05-06/234). A similar procedure is provided for in paragraph. 4 pp. “y” clause 6 of the Rules for maintaining a purchase book, approved by Resolution No. 1137.

So, in accordance with the position of officials, the landlord, when transferring utility costs to the tenant:

- “input” VAT presented by public utilities is deductible only in the part attributable to its share of consumed VAT, attributable to the share of services consumed by the tenant, is included in the cost of these services;

— the tenant is presented with the cost of utility VAT for reimbursement.

However, there is another position on this issue in judicial practice. Thus, the courts indicate that the lessor in such a situation has the right to apply a deduction (see, for example, Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated November 23, 2009 N A17-7511/2008 (left in force by the Determination of the Supreme Arbitration Court of the Russian Federation dated March 25, 2010 N VAS-3098 /10), FAS of the North Caucasus District dated December 21, 2009 N A63-8994/2004-C4-9, FAS of the Ural District dated December 11, 2008 N F09-9211/08-C2).

The essence of this position is as follows.

Agreements for the supply of electricity, heat, water, and gas are concluded between public utilities and lessors (Articles 539, 548 of the Civil Code of the Russian Federation). Therefore, the utility companies present the tax amount and issue an invoice to the buyer, i.e. to the lessor (clause 3 of Article 168 of the Tax Code of the Russian Federation). The lessor, in turn, has an obligation to provide premises for rent in the condition established by the agreement and corresponding to the purpose of the property, i.e. in a condition suitable for use (Article 611 of the Civil Code of the Russian Federation). This means with a working heating system, electricity supply, and gas supply. Thus, the purchase of utilities by the landlord is a necessary condition for renting out premises. Therefore, we can say that these services are purchased to carry out operations subject to VAT, since services for leasing property are subject to VAT (clause 1, clause 2, article 171 of the Tax Code of the Russian Federation).

Since the lessor fulfills all the conditions necessary for applying a tax deduction (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation), then he has the right to accept the entire amount of “input” VAT presented by utility service providers for deduction in full. . Then he presents the cost of utility VAT for reimbursement to the tenant.

If you consider the position stated above to be well-reasoned and accept the entire amount of “input” VAT as deduction, then you need to be prepared to defend this position in court.

EXAMPLE