Auto

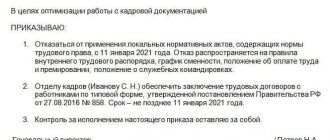

Who can maintain simplified personnel records An organization has the right to maintain personnel records in a simplified form

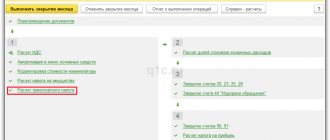

Every year, accountants, as well as entrepreneurs working without an accountant, clarify the deadlines for submitting reports and paying

Tax agent The amount of material benefit is subject to personal income tax (Article 210, subparagraph 1, paragraph 1, art.

Personal record card for the issue of workwear Similar publications In order to prevent or at least

Firstly, it should be noted that traffic police officers have the right to draw up reports on administrative offenses without

When to check? We all know that tax and accounting legislation does not provide room for

Income tax: OSAGO Expenses on OSAGO when calculating income tax relate to

SZV-M report: who submits it and when SZV-M reporting must be submitted monthly no later than 15

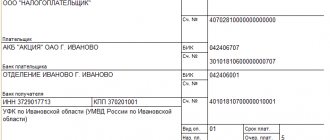

Financial payments of individual entrepreneurs in most cases are carried out in non-cash form. Their choices are related

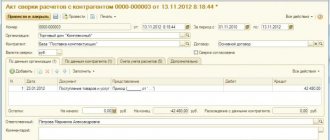

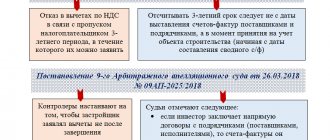

How to decipher the term “consolidated invoice” There is no official decoding of this concept. In general