Deduction

Home — Articles Deductions for goods, works, services and imports Deductions for fixed assets

Legal basis The parties entered into a loan agreement. Its maturity date is coming. But the borrower does not have

The Federal Tax Service of the Russian Federation annually determines the level of profitability for various types of economic activities,

Tax base The tax base for calculating VAT is the cost of work performed, taking into account all

Home / Taxes / What is VAT and when does it increase to 20 percent?

Cash collection involves the movement by employees of a special service of money and documentary values, such as

The amount of wages depends on how many days an employee works in a month. If month

Who must submit the form All policyholders must report to SZV-M. Insurers are organizations and

Free legal consultation by phone: 8 Russian labor legislation provides for certain guarantees of worker retention

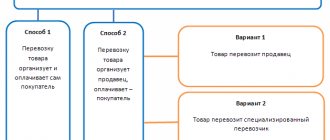

Methods for reimbursement of transportation costs under a supply agreement The supply agreement may provide for several options