Deduction

To organizations and individual entrepreneurs who have received the right to use strict reporting forms (SSR) instead of a cash document

The organization sold goods for export. How to reflect export transactions in accounting, if justified

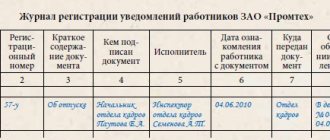

According to the requirements of paragraph 4 of Article 84.1 of the Labor Code of the Russian Federation, the work book must be transferred personally to

Letter of the Federal Tax Service of the Russian Federation dated January 26, 2017 No. ED-4-15/ [email protected] “On sending clarifications regarding the risk-based approach

Exemption from VAT through the use of special regimes The best optimization of VAT is not to pay

If the seller is a VAT evader Any transaction for the supply of goods or services is accompanied by registration

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

Federal Law FZ-54 determines how payments should be made during sales. New edition of the article

Is optimization always beneficial? VAT is included in the cost of a product or service; it is an indirect tax.

Applications at your own expense for half a day sample It should be noted that in labor legislation