Property tax rates for individuals in Moscow in 2015 - 2019 Rates

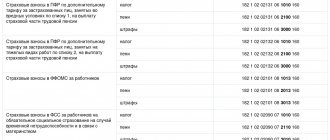

When was the last update of the BCC for insurance premiums? The last update of the BCC for insurance premiums

When the customer, after you have provided him with a service, signs the act, you have

The article discusses in more detail a fundamentally new form of reporting - this is calculation 6 -

#4 11/14/2013 11:32:08 the total amounts must match, who told you this? Bases

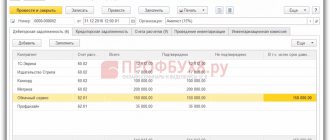

Provisions for doubtful debts under the simplified tax system In accounting, the creation of a reserve for doubtful debts

In accordance with Chapter 26.2. of the Tax Code of the Russian Federation, organizations and individual entrepreneurs have

Happy owners of apartments, rooms, country houses, garages and outbuildings are required to pay tax on

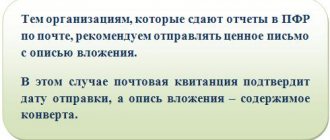

What reports to submit to the Pension Fund in 2021 Employers will submit in 2021

When carrying out the activities of an entrepreneur or organization, there is a need for accounting. Business activity directly