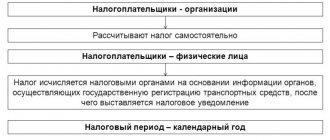

Transport tax is a regional duty paid by individual entrepreneurs, companies and individuals who own transport.

From 2021, all employers who hire workers under labor and civil law contracts must

A busy schedule prevents you from attending professional development events? We found a way out! Consultation provided

The basic version of profit taxation and deviations from it by Clause 1 of Art. 284 Tax Code of the Russian Federation

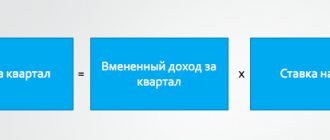

What is the coefficient K1 2021 for UTII? The use of a special imputed regime is provided for both

How to make an entry about a change of name in a work book Work book - a personal document

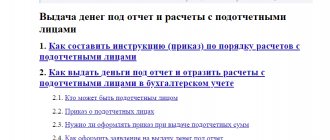

Who is entitled to receive money Accountable amounts are money that is given to employees to perform

Standard tax deduction is a reduction in the personal income tax withheld by a legal entity. The procedure for forming the tax base and

Current as of February 13, 2021 According to the rules in force today, the amount of sick leave and benefits associated

Accounting is one of the most accurate and scrupulous activities directly related to