All working citizens are required to be at their workplace in accordance with the work schedule established in

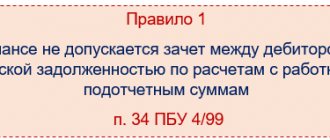

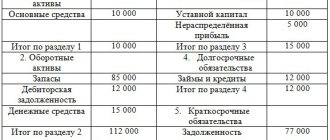

Transactions that are reflected in accounting on account 71 Account 71 in accounting is intended for

New federal standards. FSB in 2021 New federal accounting standards for government

Payers have the right to return overpaid amounts of taxes and fees or send them to

Individual entrepreneurs and organizations that are employers are required to pay monthly payments to employees working under employment contracts

Vacation reserve as an estimated liability According to PBU 8/2010 “Estimated Liabilities”, organizations must form

12/19/2015 20 326 2 Reading time: 9 min. Rating: Author: Konstantin Bely

What is reflected in account 75 It is used to summarize data on all types of payments

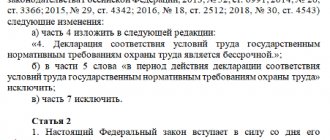

In 2021, the declaration of assessment of working conditions remains among the mandatory documents,

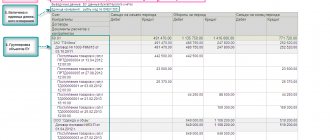

Accounting registers Let us recall that accounting registers are a type of accounting documents intended for