Added to bookmarks: 0 Individual entrepreneurship is the most common form of business organization. For physical

The enterprise profitability indicator EBIT (Earnings Before Interest Tax) or operating profit is an analytical indicator,

How to fill out a work book correctly According to Art. 66 of the Labor Code of the Russian Federation, the work book has an established

“Assets are equal to liabilities”—everyone who begins to get acquainted with management accounting hears these words.

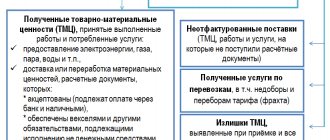

In which subaccount is the railway tariff taken into account? Note: 50 rubles VAT cannot be claimed

Taxpayer category code in the 3-NDFL declaration: what does this mean? This code takes on the following meanings:

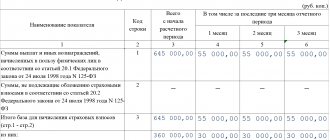

published: 08/12/2016 By virtue of Art. 228 of the Tax Code of the Russian Federation, taxpayers specified in paragraph 1 of Art.

The Russian Ministry of Finance and Rostrud are confident that the employment contract with the director is the sole founder of the company

Payers of UTII - who pays UTII and how, not all organizations could apply and

Rented to LLCs and individual entrepreneurs with employees monthly until the 15th day of the following month