Tax amnesty - let's understand the concept. In a broad sense, such an amnesty means any concessions that allow

Storage agreement The storage agreement is concluded in writing (subclause 1, clause 1, article 161,

Calculation of advance payment of corporate property tax for the 2nd quarter of 2021

• Registration • Making changes • Liquidation The site uses government services: Required when filling out forms

The UTII taxation system is one of the special tax regimes for entrepreneurs working primarily in

Has a new form 4-FSS appeared (has the form changed)? Usually before the start of the next reporting season

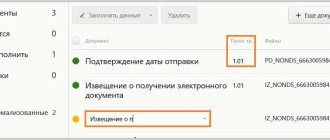

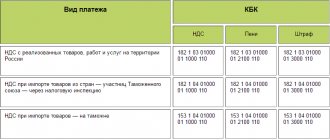

Organizations applying the general taxation regime will have to submit a VAT return for the first quarter of 2021

From January 1, 2021, a new quarterly reporting form has been introduced for tax agents: Calculation

Which form to fill out The current report form in Form 4-FSS for filling out is approved by Appendix No.

Blank form SZV-STAZH The report indicates data on accrued and paid insurance premiums for