Many citizens throughout their lives have a desire to provide selfless help to those in need. People create

As you know, during an audit, tax authorities study the organization’s primary documents. If identified

General concepts of business transactions A business transaction consists of a specific action that reflects calculation data,

How is land tax calculated and which PBU to apply? In order to determine

IFRS Magazine, No. 6, 2006 Until recently, the concept of “intangible assets” was not given due attention

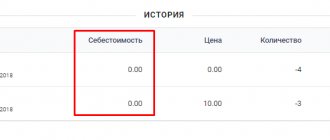

Sometimes the cost is calculated incorrectly. It can be fixed. Here are three main problems and their solutions:

Various companies are periodically forced to raise borrowed funds for their further development. There are a number

Form SZV-6-2 “Register of information on accrued and paid insurance contributions for compulsory pension insurance

How to return VAT to an individual VAT is a value added tax. Tax paid

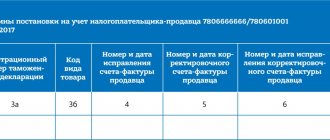

What is it, what documents can it be used instead of? UPD is active and is used in