In payment for shipped goods, the buyer can issue you his own (promissory) bill of exchange or a bill of exchange of a third party

When conducting a desk audit, Federal Tax Service specialists are based on data from declarations and calculations submitted by the taxpayer, and

Application of reduction factors By decision of the head of the organization (institution) any fixed assets in tax accounting

According to paragraph 5 of Art. 346.25 of the Tax Code of the Russian Federation, VAT amounts calculated and paid by the taxpayer from

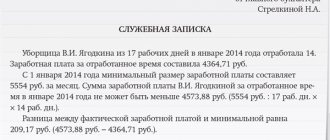

Business coach on labor law and personnel management, teacher at the Russian School of Management Yulia Zhizherina —

Sberbank uses an innovative service that provides a large number of opportunities so that corporate clients can

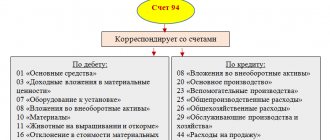

What refers to deferred income Deferred income includes receipts that are agreed upon

VAT: inventory It is known that before preparing reports for the next financial year it is necessary to carry out an inventory

Gross and marketable output of agricultural sectors Gross output is the total volume of products produced at the enterprise,

Pay taxes in a few clicks! Pay taxes, fees and submit reports without leaving your