Violations of tax legislation requirements for filling out and timely submitting Form 6-NDFL to the Federal Tax Service

Deadline for filing objections to the on-site tax audit report As of December 18, 2020 Moscow Lawyer

We will look at when tax authorities conduct a repeat tax audit. First you should know that

When calculating taxes on property rental and leasing, there are similarities and differences.

Methods for calculating depreciation Accounting has four options for calculating depreciation. Learn more about the methods

Home — Articles When the inspection makes a demand for payment of tax, penalty or fine

The accounting policy (AP) is a “particularly important” document that collects aggregate information about

In the Social Insurance Fund Quarterly By the 20th day of the month following the reporting period. \r\n\r\n

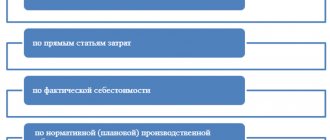

Accounting for semi-finished products of own production and their evaluation Semi-finished products of own production are materials that

Inventory card OS-6 in 1C 8.3: where to find it, how to create and print the Inventory