The price of utilities The Federal Tax Service often receives questions about whether

An organization using a simplified account (with the object “income minus expenses”) purchased goods for resale. In which

Expert of the magazine “Regulatory Acts for Accountants” A.F. Klyuev comments on the letter from the Ministry of Finance

Methods for providing a deferment Deferment is also considered one of the measures within the framework of credit debt restructuring.

Any property sold or intended for sale is a commodity (clause 3 of article 38 of the Tax Code

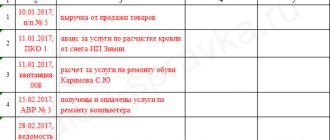

KUDiR: what is this in simple words KUDiR: what is it? The decoding is as follows: income accounting book

In attempts to optimize taxation, companies sometimes resort to dubious schemes that are well known to the Federal Tax Service.

How to file an application to the court to reduce the fine for late submission of SZV-M? Pension Fund

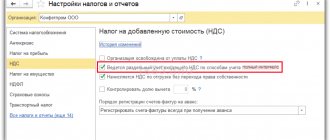

The need to confirm the zero VAT rate appears for the seller when goods are sold

Home — Articles Conditions and restrictions on the application of the tax regime Features of accounting for agricultural producers’ expenses