There are as many types of taxes as there are so many penalties and fines for them. For each type

General rules for maintaining off-balance sheet accounting. According to clause 332 of Instruction No. 157n, the following are reflected in off-balance sheet accounts:

Question for the auditor Joint-stock companies have been removed from the list of organizations that are subject to mandatory audit. They fall under

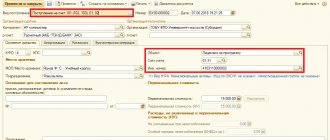

Why change an object under the simplified tax system and how to register a businessman who switches to the simplified tax system in

Entrepreneurs of the Ulyanovsk region will receive tax benefits and concessions due to the pandemic on March 19

Many working Russians apply to the Federal Tax Service for a tax deduction: someone wants to reimburse part of the costs

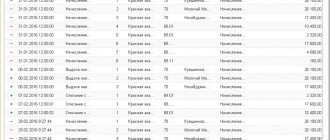

The procedure for liquidating a business The termination of commercial activity is registered with the tax authorities at the place of residence. Legal

Non-current assets All property of the organization is divided into non-current and current assets. The first include

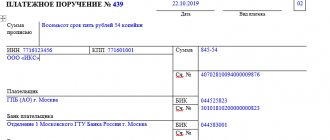

In the process of reflecting the facts of economic activity and preparing primary documents, each accountant needs to form

Author: Ivan Ivanov Regulatory acts of the Labor Code of the Russian Federation regulate the possibility of recalling an employee from vacation