Payment

“Two things are inevitable in life: death and taxes.” These are the words of the American politician Benjamin

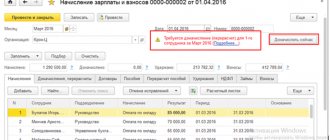

In what cases is it necessary to recalculate insurance premiums for previous periods? Typically, updated data is submitted

Payment of VAT in 2018: payment deadlines for companies and individual entrepreneurs on the general taxation system

Tax Code of the Russian Federation. Chapter 28 1. Taxpayers who are organizations calculate the amount of tax and the amount

Any independent financial transaction requires the need for an account opened in the name of the payer. Due

Income tax return: reflection of dividends The receipt of dividends by the company is indicated as part of income,

The Board of the Pension Fund of Russia, by its Resolution No. 507p dated December 6, 2018, updated the reporting forms (the changes are valid from

Travel expenses include employee travel expenses, housing rental expenses, daily allowances and

New deduction codes In 2-NDFL certificates submitted in 2021, section 3 is reflected

Types of bonds in circulation and by form of income There are state (federal, regional,