Payment

Very often, overpayment of salary to an employee can be caused by vacation, or more precisely, its overexpenditure or advances,

An entrepreneur is registered as an employer only by the Social Insurance Fund. Therefore, if you fired all your employees and

Who should not submit the calculation If the organization does not have fixed assets recognized as objects of taxation,

Home / Bankruptcy / Bankruptcy of legal entities Back Published: 09/06/2019 Reading time: 4

Transport tax must be paid by December 1, 2021. If this is not done on time,

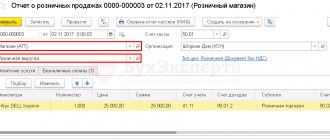

We continue to talk about support for acquiring operations in 1C: Accounting 8 edition 3.0*. In this article

To produce any type of product, resources are required - raw materials, semi-finished products, fuel. Materials are purchased for

Accounting for third party services Third party services are a type of activity that is not

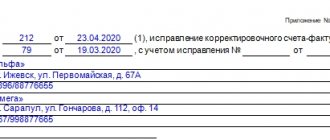

A universal adjustment document includes an adjustment invoice and a notice of a change in the price of the goods,

Fine for non-payment of personal income tax As a general rule, if the tax agent does not withhold and/or