Payment

The employee was called back from vacation and was compensated for travel expenses Amount of payment (compensation) for an unscheduled flight

In the first (electronic) issues of the magazine, we already introduced the reader to the procedure for accrual and payment

Contents of the document The conditions and procedure for drawing up a debt transfer agreement are regulated by paragraph 2 of Chapter 24

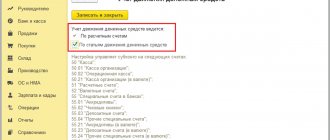

Cash is the most liquid part of operating assets and represents money on hand, and

Pay taxes in a few clicks! Pay taxes, fees and submit reports without leaving your

Definition and features of provision The Labor Code does not contain wording of such a concept as advance leave.

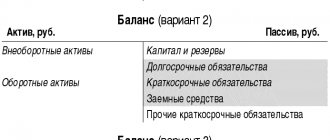

Introduction The development of the world economy has led to a variety of sources, forms and conditions for attracting borrowed capital.

How to calculate the simplified tax system for individual entrepreneurs - with simplified taxation, the tax period is considered to be a calendar year, and

KUDIR is a book of income and expenses that must be maintained by all organizations and

Transactions with non-residential premises - shops, offices, garages, basements - are in demand on the market