Payment

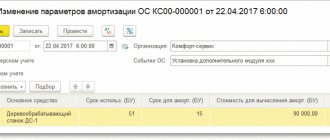

Modernization of a fixed asset 1C BGU 8.2 Modernization is a change in the value of a fixed asset from

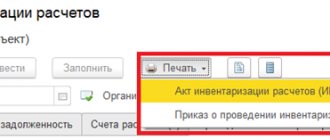

Write-off of receivables can be of two types: taken into account for tax purposes and not taken into account. So

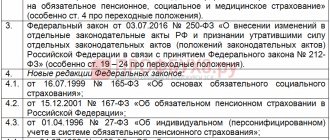

From January 1, 2021, the Tax Code has been supplemented with a new chapter 34 “Insurance premiums”. IN

According to labor legislation, an employee of an organization or individual entrepreneur with whom he has a registered labor

The deadline for submitting the DAM is established by the Tax Code of the Russian Federation in paragraph 7 of Art. 431 – up to

Accounting statements of small enterprises can be prepared in two versions - according to the usual reporting templates

How to calculate average earnings for piecework wages Hello, I work in a processing shop

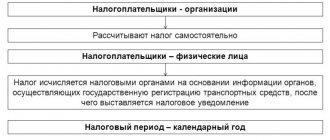

Transport tax is a regional duty paid by individual entrepreneurs, companies and individuals who own transport.

From 2021, all employers who hire workers under labor and civil law contracts must

The basic version of profit taxation and deviations from it by Clause 1 of Art. 284 Tax Code of the Russian Federation