Payment

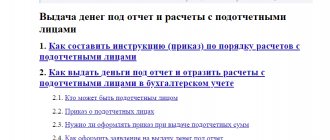

Who is entitled to receive money Accountable amounts are money that is given to employees to perform

What is the coefficient K1 2021 for UTII? The use of a special imputed regime is provided for both

Accounting is one of the most accurate and scrupulous activities directly related to

From 2021, the payment of insurance premiums comes under the control of the Federal Tax Service. Changes in administration are related

Personal income tax rate on dividends Until 2015, tax on dividends had to be withheld at

2021-05-28 1851 One of the stable sources of replenishing the country’s budget is the personal income tax

Author: Alena Donmezova - RKO Specialist Date of publication: 10/09/2019 Current as of May 2021

When a legal entity buys any vehicle and puts it on the balance sheet of the enterprise, it

Innovations in the declaration under the simplified tax system in 2021. Useful documents on changes in the tax

Daily allowances are one of the items of employee travel expenses subject to mandatory reimbursement. It is their payment