Payment

The balance sheet is a display of the activities and financial condition of the organization, as well as identification of sources,

What's new Adjustments to the form of the book of income and expenses from 2021 were made by orders

If you are not familiar with the first two parts, then you can find and familiarize yourself with them

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

What it is? Insurance payments under compulsory motor liability insurance are the money that the owner of the car receives,

The essence of the Unified Agricultural Tax 2021 The Unified Agricultural Tax system itself is one of 5 special tax regimes,

On January 1, 2021, the write-off of some debts of individuals that were recognized as bad began.

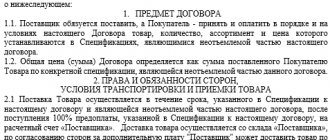

Document type: Supply Agreement In order to save a sample of this document to your computer

The taxpayer replenishes the country's budget with his payments. Money goes to solving important problems. For example, aquatic

Spouses can acquire real estate (apartments, dachas, land) during marriage as joint property.