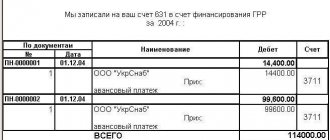

Payment

The essence and types of the document The specifics of bonuses are determined by 2 points: This is a voluntary act of the employer, i.e.

A physical indicator is a value directly related to the calculation of a single tax on imputed income.

Varieties According to the content of the financial transaction, according to the movement from the sender to the recipient, we divide several groups

Do penalty liabilities reduce profits? Provisions of paragraph 2 of Art. 270 of the Tax Code of the Russian Federation do not allow

In this article we will examine the concept of goods and materials, what they are, what

Do I need to pay tax on a car purchased in 2013? Benefit for movable property,

A tax return not submitted on time. Ignorance of deadlines or forgetfulness leads to the fact that an entrepreneur

Source: Journal “Unified tax on imputed income: accounting and taxation” Taxation system in

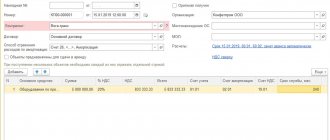

This article describes the method of reflecting an increase in the initial cost of fixed assets in 1C: Accounting 8.

“Forbidden” digits of the payment order number Payment order number is a mandatory detail, and in the form 0401060