Documentation

The Federal Tax Service (FTS) has a special personal taxpayer account for individuals, functionality

We submit the VAT return for the first quarter of 2021 using an updated form. For the first time

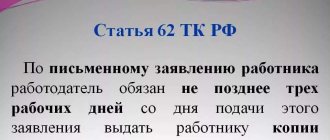

How long a personal income tax certificate 2 is issued to an employee by an employer is determined by law. The tax agent is obliged to provide the interested party with

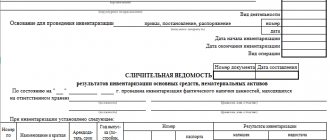

What is the INV-19 form? Based on the INV-19 form, a matching statement is drawn up, in which

The first thing HR officers and accountants do when an employee returns after illness is ask for a piece of paper

How to fill out the 6-NDFL calculation for the 4th quarter of 2021? Has the new payment form been approved?

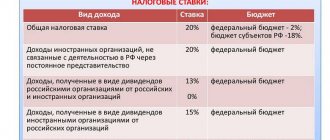

In order to reduce the tax burden on Russian citizens, the state uses a number of mechanisms that allow

The definition of a tax return is given in Article 80 of the Tax Code of the Russian Federation. This is a document drawn up in accordance with

Who must submit the 6-NDFL report and when? The 6-NDFL report is submitted every quarter and

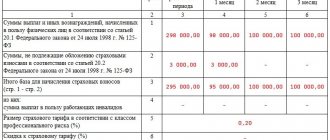

In 2021, insurers will submit calculations in Form 4-FSS for contributions for “injuries” to