Documentation

Most often, individual entrepreneurs choose a simplified taxation system, since it is really simpler and

FFOMS – contributions for compulsory health insurance. They are paid by all organizations regardless of form

Using intermediaries in business helps optimize tax payments. However, through the efforts of the Federal Tax Service and Rosfinmonitoring, this

Form P-6 to Rosstat in 2021 is included in the list of reports that must be submitted

Added to bookmarks: 0 The tax return under the simplified tax system is submitted in a single copy. If you

Valid codes for 2021 Codes for the type of transactions in the purchase book valid for the current year,

The Tax Code of the Russian Federation does not contain the concept of “zero reporting”, but most often it means

KND 1160080 is a certificate issued by the local Federal Tax Service of the Russian Federation on the status of payments of an individual entrepreneur

How should a tax return under the simplified tax system for 2020 be completed? in Excel,

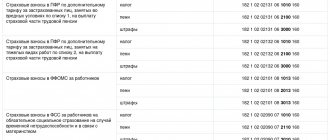

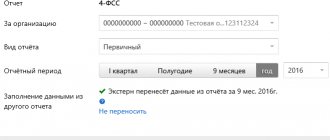

Policyholders regularly submit reports to the Social Insurance Fund. If the company employs 25 or more people,