Documentation

Providing explanations to the tax office regarding 6-NDFL Form 6-NDFL is submitted by tax agents quarterly, starting from

Small businesses in Russia enjoy special benefits intended only for them. The state is going to

Incentive payments can be part of the salary, or can be issued as additional accruals.

Deregistration of a cash register is necessary if the cash register is no longer needed (for example, due to the closure of an individual entrepreneur),

Home / Taxes / What is VAT and when does it increase to 20 percent?

Who is entitled to receive money Accountable amounts are money that is given to employees to perform

Significance The effectiveness of the functionality of an enterprise of any size is determined, among other things, by the state of its office work. Impossible

Personal income tax is a tax that citizens of the Russian Federation pay to the treasury on the income they receive. Employers are obliged

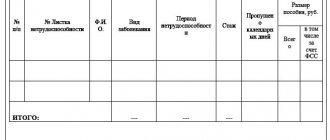

With an eye to verification A document such as a sick leave certificate has serious legal force, which

If necessary, you can request a 2-NDFL certificate from your employer. Refuse to issue you a certificate from your employer