Auto

Trade organizations regularly face the need to write off goods that have become unusable. First of all, this

Form T-10 is a form for a unified sample of primary accounting of labor and wage documentation

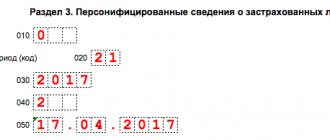

How to correctly fill out the RSV-2 PFR form for peasant farms. In column 2, write down your full name line by line.

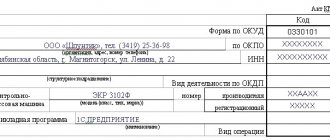

The standard unified form KM-1 is called “Act on transferring the readings of summing money meters to zeros

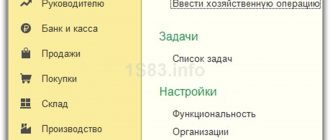

Before you begin full work in the 1C 8.3 Accounting 3.0 program, you need to configure

What is a self-employed person in the understanding of the tax code? What is “self-employment” in simple words? This

N 67n (as amended by Order of the Ministry of Finance dated August 17, 2012 N 113n) – due date 31

Depreciation groups of fixed assets in 2021 are determined according to new rules. The table will definitely help

Reserves for doubtful debts: accounting and tax accounting Reserves for doubtful debts are also formed in accounting,

Date of publication 04/07/2021 12407 views Useful for individual entrepreneurs and LLPs From April 2021