Any employer must provide annual basic paid leave: a legal entity, an individual entrepreneur. In this case, it does not matter whether the employee is employed full-time or part-time, whether he works on the employer’s premises or at home, what position he holds, for how long the employment contract was concluded (for an indefinite period or fixed-term), in what form he receives wages.

It is prohibited not to provide leave:

- employee for two consecutive years;

- employees under the age of 18;

- workers engaged in work with harmful and (or) dangerous working conditions (Part 4 of Article 124 of the Labor Code of the Russian Federation).

Violation of this requirement may result in administrative liability.

Features of transferring vacation to next year

According to the norms of labor legislation, and more specifically Article 124, the transfer of a certain part of the vacation period to the next working period is allowed only if the following conditions are met:

- Mutual agreement between employer and subordinate. It is impossible to carry out this procedure if one of the parties to the labor relationship is against its implementation;

- The presence of serious reasons;

- The labor obligations assigned to the employee can be carried out continuously throughout the year without harm to health.

The main features of the vacation transfer procedure include:

- The annual leave provided by the Law does not automatically expire if it has not been used in full. In this case, the remaining days off are added to the vacation period of the next year;

- Transfer of leave is allowed only if the employee’s health does not suffer harm or any other damage;

- It is not allowed to carry forward part of the vacation 12 months in advance for pregnant women, minor teenagers and employees working in hazardous workshops. The entire number of days off provided must be used by individuals in the current working period;

- Carrying forward holidays not taken is allowed only 1 year in advance. Carrying out this procedure for two consecutive years is prohibited;

- If the employer violates the requirements of the Labor Code of the Russian Federation, the employee can contact the relevant government bodies that are responsible for monitoring compliance with the labor rights of employees.

Transfer of vacation to the next working period at the initiative of the employee

The transfer of days of required rest can be carried out at the proposal of any of the parties to the labor relationship. If this decision is made on the initiative of the employee , then he is obliged to provide the appropriate grounds, which will need to be presented to the employer at the time of filing the application. As a rule, the desire to transfer part of the vacation to the next year arises when an employee has certain plans/events that require more days off than are provided annually under the Law.

The most significant circumstances that can be presented to the employer are:

- Situations in which the employee’s illness or injury that requires long-term treatment occurs during the vacation period. If the employee receives a certificate of incapacity for work, the employer is obliged to extend the current vacation to the subordinate or postpone the period of rest, similar to the number of days of illness, to other dates, including 12 months in advance;

- The employer did not accrue the appropriate amount of vacation funds to the subordinate 3 days before the start of the vacation. The employee, in turn, has the right to write an application to transfer the granted period to other dates;

- Lack of a notification document that must be sent by the boss 14 days before the start of the upcoming vacation;

- The citizen’s vacation period coincided with the fulfillment of state tasks assigned to him that required urgent solutions;

- Other circumstances that are recorded by the legislator in regulations.

When it is prohibited to reschedule vacation

Annual paid leave must be extended or postponed to another period determined by the employer taking into account the wishes of the employee upon the occurrence of temporary disability of the employee himself (Article 124 of the Labor Code of the Russian Federation).

But if during the next vacation the employee took sick leave to care for a child, the employer is not obliged to extend or postpone the employee’s vacation for the period of incapacity.

Moreover, a certificate of incapacity for work for caregiving is not issued during the period of annual paid leave and leave without pay (clause 40 of the Procedure for issuing certificates of incapacity for work, approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n). That is, sick leave for child care should not be issued during the regular vacation; it is not paid and does not affect the total duration of the employee’s vacation.

And if an employee nevertheless takes sick leave during vacation and does not go to work on time, then he risks being fired for absenteeism.

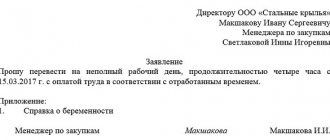

Rules for filing an application for transferring vacation

The entire procedure for transferring vacation dates to another period of time is initiated only after the employee submits a special application addressed to the management of the organization. The main purpose of drawing up this document is to present a request for the preservation of non-vacation days and the possibility of using them in a future working period. The application must contain the following details:

- Personal information of the head of the company, indicating his position;

- Personal data of a full-time employee, as well as his position;

- The text part, as previously mentioned, should contain a request to postpone the vacation. It is imperative to indicate which particular period of rest is subject to shift, as well as its new dates;

- The reason on which an employee can transfer a certain part of the vacation to the next year;

- A list of official documents that confirm the existence of the transfer circumstances specified in the application;

- Date of application;

- Personal signature of the applicant employee.

The employer will make a positive decision on this employee’s request only if its implementation does not have a negative impact on the production process and does not in any way infringe on the interests of the employer.

In Russia, the one who knows his rights wins

If you want to know how to solve your specific problem, then ask

our duty

lawyer online

.

It's fast, convenient and free

or by phone:

Moscow and region:+7

St. Petersburg and region:+7

Federal number:+7

Some principles for accounting for rolling leave

Calculated insurance premiums (or premiums), as well as taxes and other fees, are included in expenses for the period in which they were credited.

FSSO, PFR, FFOMS contributions are calculated and paid for the software. Insurance fees are most often not distributed between months. For example, if an employee went on vacation in June and returned from it in July 2017, then insurance payments for vacation pay are taken into account in June 2021. Expenses are fully reflected in the declaration for the second quarter of 2021. However, if, for example, the vacation began in December year, but ended in a month of another year, accounting is kept differently. Vacation money is an expense included in wages. These software amounts are distributed in proportion to vacation days. They need to be included as expenses every month.

https://www.youtube.com/watch?v=ytcopyrighten-GB

Under the simplified tax system (Income), the single tax is reduced by the amount of insurance premiums in the period when they were transferred to the fund. However, there is a limit of no more than 50%. Vacation pay themselves do not affect the single tax, because no expenses are taken into account under such a taxation object.

Under the simplified tax system (income - expenses), the obligated person has the right to reduce his income by the amount of expenses for wages. Vacation pay (and in relation to software) is considered an expense at the time of issue. As for insurance premiums, they also reduce the tax base when paying a single tax on the date of payment.

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

The software is subject to standard tax deductions for the vacationer and his children (Tax Code of the Russian Federation, Article 216). The only caveat is that this benefit applies only for one month, and not for both (that is, even when the vacation begins in one month and ends in another). This means that the deductions due to the vacationer are not distributed between months, but are recognized in the generally accepted manner for the current month. It is noteworthy that such benefits can be used both in vacation pay and wages.

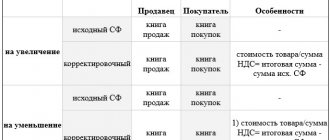

| Deduction option | Conditions for providing benefits in the form of a deduction | Base |

| On your children | For each minor child, until the end of the year in which he turns 18; for full-time students up to 24 years of age | Tax Code of the Russian Federation, art. 218, clause 1, sub. 4; Letters of the Ministry of Finance No. 03-04-05/53291 dated October 22, 2014 and No. 03-04-05/8-1251 dated November 6, 2012 |

| To myself | The benefit is provided to participants and victims of the Chernobyl Nuclear Power Plant, participants and disabled people of the Second World War, former prisoners of concentration camps, heroes of the USSR and the Russian Federation, disabled people from childhood and groups 1 and 2, as well as other categories of persons specified in the Tax Code of the Russian Federation | Tax Code of the Russian Federation, art. 218 |

To exercise his right to a benefit, an employee must contact the employer (tax agent) with an application for the provision of this type of benefit and attach to it proper documentary evidence of the right to a deduction, such as: a copy of the certificate of a WWII veteran, a participant in the liquidation of the consequences of the Chernobyl nuclear power plant, etc.

The procedure for transferring vacation to the next year at the initiative of the employer

Employers also have the right to shift the vacation of subordinates to a different time interval than was previously recorded in the vacation schedule, however, this opportunity is given to them only in case of a desperate situation and the impossibility of doing otherwise. The following requirements must be met:

- Transfer is allowed no more than 12 months in advance;

- This employer’s proposal must be agreed upon with the subordinate. If the latter is against its implementation, the employer does not have the right to implement it alone;

- Transferring a vacation period is possible only in case of production necessity, when without the presence of a specific employee at the workplace, certain damage to the organization’s activities may be caused.

The procedure for shifting rest dates to a future working period is as follows:

- Sending a written notice to the employee indicating the proposal;

- Drawing up by the employee of a response document expressing consent or refusal to implement this procedure;

- If the parties managed to reach a mutual agreement, the company issues an Order to transfer the vacation period to other dates;

- HR department specialists make appropriate changes to all necessary employee documentation.

If the transfer of vacation is carried out at the initiative of the employer , then the employee next year is allowed to choose absolutely any vacation dates, without observing the order of their provision according to the approved schedule.

No rating yet

Categories of employees for whom the employer does not have the right to refuse to shift vacation dates

Various legislative acts, including the provisions of the Labor Code, establish a list of workers who are allowed to go on unplanned leave at any time or, upon request, transfer the dates of the vacation period to more convenient ones:

- An employee who is the adoptive parent of an infant whose age does not exceed three months from birth;

- The spouse of a woman who is on maternity leave due to an imminent birth;

- An employee who wants to add her existing vacation period to maternity leave, which she plans to go on soon;

- An employee who is a biological parent/guardian/adoptive parent of a child with a disability who has not reached the age of majority;

- An employee who has not yet turned 18 years of age;

- An employee employed part-time, who takes leave from his main job during the same period;

- A person who suffered during the Chernobyl accident or took an active part in eliminating the latter;

- An employee who received a certain dose of radiation during nuclear weapons testing in Semipalatinsk;

- To a subordinate who has the “Honorary Donor” insignia;

- An employee who has an officially recognized disability group;

- A person who previously took part in hostilities or is a participant in the Second World War;

- The husband or wife of a military personnel who is granted unscheduled leave;

- A police officer who has not previously used the vacation period provided to him according to the developed schedule;

- Other persons to whom the legislator grants this labor privilege.