Deduction

ATTENTION! Wage indexation in 2021 in commercial organizations Inflation is a process

Subsection 3.2 (3.2.1 - lines 190-250 and 3.2.2 - lines 260-300) All other sheets

There is no clear formulation of the sales receipt in the specialized literature. However, it is legally valid

When an employee is entitled to compensation for the use of a personal car Regulations for the calculation and accrual of compensation for

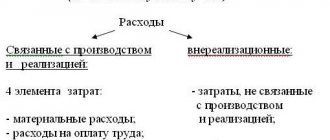

Operating expenses are expenses that a business incurs to maintain its operations, such as wages

Home — Articles Most manufacturing and trading organizations provide customers with a guarantee on the goods they sell.

Tax agent is a person charged with the responsibility for transferring taxes by the Tax Code of the Russian Federation.

The form of the payment order is fixed in a special form according to “OKUD-0401060”, which is contained in a separate Appendix No. 2 in

The decision of the first instance did not satisfy anyone. Based on the results of the on-site inspection, large sums were accrued to the company

Home / Real estate / Purchasing real estate / Buying an apartment / Deduction Back Published: 12/28/2017