Disclosure of the content of a business transaction

Clause 2 of Article 9 of Law No. 129-FZ requires reflection in the primary accounting documents of the content of a business transaction, as well as its measures in kind and cash. This requirement can easily be met in relation to business transactions that have a material expression, for example, those associated with the supply of goods. But what if we are talking about services, for example, promoting a product on the market?

The Russian Ministry of Finance expressed an interesting point of view on this issue in its letter dated 04/05/2005 No. 03-03-01-04/1/170. This letter deals with the provision of services aimed at promoting goods. In accordance with the text of the letter, the Ministry of Finance considered a situation where, based on the terms of an agreement concluded by a wholesale trade organization (customer) with large chains of grocery stores (executors), the contractor is obliged to:

- ensure the presence of customer goods in an agreed assortment in all stores;

- ensure the share of the display of the customer’s goods is at least 50% of the total display of similar goods;

- ensure the current minimum stock of customer goods in each store of at least 10 boxes.

Payment for the services of the contractor is carried out on the basis of the act of provision of services and invoice presented by him at the end of each quarter.

According to the Ministry of Finance of Russia, the costs of paying for the services of the contractor for promoting goods cannot be taken into account by the customer when determining the tax base for income tax due to the fact that the act drawn up based on the results of the quarter cannot reflect the actual fulfillment of the above obligations of the contractor during the quarter . Therefore, the organization’s expenses incurred on the basis of this act do not meet the conditions of documentary evidence.

It is difficult to imagine how the Ministry of Finance of Russia proposes to reflect the performance of these services - to include in the drafted act of provision of services the full range of goods in stores, to calculate the percentage of product display, or to indicate the stock of the customer’s goods in each store? And on what date should this data be provided if the report on the provision of services is drawn up based on the results of the quarter?

Of course, it is impossible to reflect the performance of the above services in acts in the form and to the extent required by the Russian Ministry of Finance. If you follow the logic of the Russian Ministry of Finance, you can also question the legality of attributing labor costs to expenses, since it can be argued that the working time sheet, on the basis of which the employer calculates wages, reflects only the fact of the employee’s presence at the workplace, and failure to fulfill his official duties. In accordance with labor legislation, wages are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed, as well as compensation and incentive payments. Reasoning in this way, we can come to the conclusion that the time sheet will not be the primary document confirming the legality of the organization’s attributing labor costs to expenses, since a situation is theoretically possible when the employee was at the workplace, but was not directly responsible for his work duties. didn't do it?

In fact, fulfilling the terms of the agreement discussed in the said letter will require the contractor to assign additional labor responsibilities to its employees, which should be reflected in the relevant job descriptions. It is these job descriptions that should be considered as additional evidence of the contractor’s fulfillment of the terms of the contract.

Indeed, in accordance with paragraph 6 of Article 108 of the Tax Code of the Russian Federation, the obligation to prove circumstances indicating the fact of a tax offense and the guilt of a person in committing it is assigned to the tax authorities, and irremovable doubts about the guilt of the person held accountable are interpreted in favor of this person.

At the same time, the arguments reflected in the letter in question, indicating the need to prove the fact of the actual provision of services, have already been encountered in law enforcement practice.

Similar arguments were given by the FAS of the Volga-Vyatka District in a resolution dated January 19, 2004 in case No. A11-4426/2003-K2-E-1961 and by the FAS of the North-Western District in a resolution dated August 30, 2004 in case No. A56-26880/03. When considering these cases, arbitration courts examined not only certificates of work performed, but also other documents (in the first case - job descriptions of administrative and managerial personnel, in the second - equipment inspection reports confirming (refusing) the need for repair work).

And although during the consideration of these cases it was established that the certificates of work performed did not comply with the requirements of Law No. 129-FZ, as a result of which they could not be the basis for including costs as expenses (both cases were lost by the taxpayers), the arbitration courts considered all documents in any way related to the performance (in this case, non-performance) of the controversial work.

Earlier, the Department of Tax Policy of the Ministry of Finance of Russia, in its letter dated April 30, 2004 No. 04-02-05/1/33 “On the recognition in tax accounting of expenses under civil law contracts,” expressed a slightly different point of view on the need to provide a certificate of work performed (services rendered) ) as a supporting document. Based on the fact that the albums of unified forms of primary accounting documentation do not contain forms of primary documents formalizing the relationship of the parties arising under an agency agreement or a contract for the provision of paid services, the Ministry of Finance of Russia concluded that in order to recognize taxpayer expenses incurred under civil law contracts, the certificate of work performed (services rendered) is a mandatory supporting document only if the preparation of this document is mandatory in accordance with civil law and (or) the concluded contract.

Here the question inevitably arises: on the basis of what document can costs under such contracts be included in expenses?

I would like to believe that when preparing this letter, the Russian Ministry of Finance did not formulate its position precisely enough. Paragraph 2 of Article 9 of Law No. 129-FZ clearly indicates that primary accounting documents must be compiled according to the forms contained in the albums of unified forms, and documents whose form is not provided for in these albums must contain a list of mandatory details. It has already become a custom of business practice in our country for the parties to the contract to draw up certificates of work performed (services rendered) based on the results of work (provision of services), and it is this document that is considered as the primary accounting document confirming the fact that organizations have carried out a business transaction.

Perhaps the Ministry of Finance of Russia in letter No. 04-02-05/1/33 meant that if, in accordance with civil legislation and (or) a concluded agreement, a certificate of work performed (services provided) is drawn up, then it should be the document confirming expenses incurred. Otherwise, any other document can be used as a supporting document, confirming the fact of completion of work (provision of services) and containing, in accordance with paragraph 2 of Article 9 of Law No. 129-FZ, a list of mandatory details (for example, a report on the work done or a memo on the provision of services).

The expenses are not documented. What to do?

Material provided by the editors of the berator “A check has come to you”

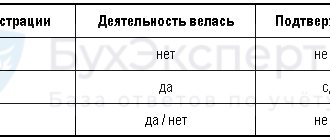

It happens that primary documents are missing for some reason. For example, they were lost when the company moved or as a result of an emergency (fire, robbery, etc.). How does this threaten the company? During the next audit, tax officials will definitely pay attention to this and fine the company. What to do?

The absence of primary documents is considered a gross violation of the rules for accounting for income and expenses (Article 120 of the Tax Code of the Russian Federation). The fine for this violation will be 5,000 rubles. If the lack of documents led to an understatement of tax, then the fine will be 10 percent of the amount of unpaid tax, but not less than 15,000 rubles.

To avoid liability, we suggest doing the following. The first thing an accountant needs to do in such a situation is to prove his innocence in the absence of primary documents.

Advice: draw up a report that lists the missing documents and the reason for their absence. This act must be approved by the head of the company.

If documents are lost due to fire, theft or other emergency, you will also need a certificate confirming that such a situation actually occurred. So, if there is a fire, then a certificate from the fire department is required; if there was a flood - a certificate from the organization that operates the building; if documents were stolen - a certificate from the police.

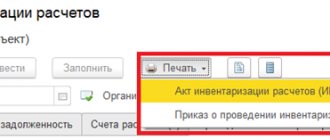

It happens that a new accountant comes to a company and cannot understand the documentation, because his predecessor did the accounting “carelessly.” To avoid such misunderstandings, we recommend that you take an inventory before starting work.

If it was not possible to carry out the inventory, and the new accountant has started work, then we advise you to contact the previous accountant and demand from him a written explanation of why certain primary documents are missing. Then draw up a statement of absence of documents. Thus, responsibility for the lack of documents from you, as a new accountant, will be removed.

Another unpleasant moment that threatens an enterprise in such a situation is additional taxes and penalties. The fact is that expenses that are not documented cannot be taken into account when calculating income tax. Otherwise, the tax authorities will consider that the tax base for income tax was underestimated, and will charge additional tax, as well as collect penalties. To avoid tax penalties, we advise you to try to restore the missing documents.

If, for example, there are no documents confirming the purchase of goods (works, services), agree with the suppliers so that they issue you copies of all the necessary documents.

Of course, you can restore the missing documents only if you know exactly which documents you are missing to confirm expenses, as well as from which suppliers the goods (work, services) were purchased.

It is much more difficult if, for example, papers confirming the issuance of money on account to an employee who is no longer working for the company are lost. The easiest way out of this situation is to try to contact this employee and agree with him to re-issue the necessary documents retroactively. What to do if it is impossible to contact this employee (for example, he moved to another city)?

Advice: fill out the missing documents for another employee who also worked at the company on the date of the lost document.

Falsification of “primary” expenses

If you buy certain goods that are not economically justified in any way (for example, products for the holiday table), the accountant can be clever with the “primary” document that will be used to process the purchases.

As a rule, market traders do not care what to write on sales receipts, invoices and other documents. Whatever you ask them, they will write to you. Therefore, when giving money to employees on account for the purchase of products, warn them in advance so that there are no cervelats, champagne or oranges in the documents. The best option is to receive a blank “primary form” from the sellers and complete it yourself. Most sellers will agree to this. In this case, cervelat will turn into stationery, champagne into writing paper, oranges into a printer cartridge or staplers.

To easily process purchases through accounting, you need to receive from your accountants:

– cash register receipts;

– sales receipts or invoices certified by the seller’s seal.

Please note that cash register receipts do not contain the name of the purchased product. Otherwise, the receipt will indicate that sausage was purchased, and other documents will indicate “stationery.” That is why it is better not to buy products in large supermarkets. Usually their cash registers indicate the name of the goods in receipts, which cannot be said about small wholesale markets.

If you are lucky, you will be able to receive invoices and cash receipts from sellers. In this case, you will include the cost of goods as expenses and will be able to recover VAT on them. But these documents, as a rule, are not prepared by most traders.

How to design a “linden”

Suppose you are planning an arbitration dispute with the tax inspectorate. But there are no documents confirming that you are right. Many people, without hesitation, formalize them retroactively. Moreover, the signatures and seals are authentic. Or another situation. The director gave instructions to reduce taxes. For this purpose, the accountant himself (or together with the director) drew up documents confirming that a certain non-existent company provided them with services or supplied goods. It's easier than ever to fake a seal. There are a lot of workshops for their production. Is it easy to prove a document is falsified? Experts will tell us about this.

First, let's look at the preparation of papers in retrospect. It turns out that the time of writing a document can be determined by notes (for example, signatures) made with a ballpoint pen. Stanislav Shapovalov, director of the Versiya Bureau of Independent Expertise, told us about such a study: “Ballpoint pen paste is, in principle, the same paint that we use to paint walls. In addition to the pigment that gives color, the paste contains a binding element - a thickener. Thanks to it, the paint adheres well. Scientists have noticed that the thickener hardens over time. Scientifically, this process is called polymerization. The harder the thickener, the older the entry on the document.

To determine the degree of polymerization (thickening), you need to extract a highly volatile component from the paste (for example, phenylglycol or benzyl alcohol) and determine its concentration on the surface and in the “depth” of the signature. The lower the ratio of these values, the greater the thickening, which means the older the signature. Experts determine the degree of concentration using a special device - a chromatograph with a mass selective detector.

Such a study is called a physical and chemical examination of the prescription of the signature. There are currently no other reliable methods. There are, of course, all sorts of attempts. For example, some experts conduct signature research from a handwriting perspective. The method is based on the fact that over time, a person’s signature acquires some new characteristics and loses old ones. If you have samples made at different times, you can establish when the signature submitted for examination was made. This method is currently under development. Little factual material has been accumulated on how a person’s signature changes, so for now I evaluate this method quite critically.”

Pastes age in about two years. If the document is more than two years old, there is no point in contacting experts: this is exactly the answer they will give. The accuracy of the period within two years depends on how much time has passed since the signature was applied to the paper. If it was done, for example, a week ago, then the expert will tell you the exact date. If several weeks or months have passed, then the accuracy will be calculated in weeks or months, respectively. Well, if the recording is more than a year old, then the expert will set the period with an error of six months. Then in the conclusion it will be written that the document was drawn up from a year to one and a half years (or from one and a half to two years) ago.

“It won’t work out more precisely,” says Stanislav Shapovalov. – Signatures made with the same pen and at the same time often give different results. Moreover, this does not depend on the paper, it can be different: new, old, cardboard, yellow, etc., but on where and under what conditions the document was stored. It’s one thing if it was lying in the room, and another thing if it was in some archive, in the basement. The temperature there is usually lower. If you heat a document too much, for example by placing it on a radiator or running an iron over it, it will become artificially old. The paste will dry quickly, and the expert will no longer be able to determine how long ago the signature was written. But he will definitely establish that the document was artificially aged, and will reflect this in his conclusion. This means that it will be clear to the court that the papers are forged.”

So far we have been talking about ballpoint pens. What about feather ones? It turns out that everything depends on the material of the letter. “If you dip a pen in the paste of a ballpoint pen, the result will be the same,” explained Stanislav Evgenievich, “but if you use a water-based dye, for example ink, then the expert will no longer determine the age of such records. Scientists have not yet discovered that anything in ink changes over time. Except that within a minute of writing, the water dries out of them.” The expert did not continue his thought further, but it is already clear that when drawing up a document in hindsight, it is better to write, for example, in “Rainbow” ink. You won’t find fault, you won’t undermine.

The same can be said about the seal impression. If you use ink, then the age of printing cannot be determined, but if there is a special mastic that contains a thickener, then you can. But the time frame here is shorter than for ballpoint pen paste. The easily volatile component contained in the mastic evaporates within six months. Nothing further happens to the mastic. This means that it is possible to more or less accurately determine the time when the seal was affixed only within the first six months.

A very similar mastic is used in gel pens and inkjet printers. “Most often it is organic rather than water-based. The prescription here can also be established within six months, explained Stanislav Shapovalov, but the materials used in the laser printer do not change over time. This means that the expert will not be able to determine from them when the document was printed. True, it is possible to detect a forgery of a document printed on a laser printer. I mean cases when an accountant prints the required text on sheets that already have the manager’s signature and the company’s seal. If the text is partially printed, then the expert can determine exactly what comes first. If the seal was placed on top of the text, then everything is fine, but if it’s the other way around, then the document is fake.”

Backup options

Some criminologists believe that the age of a document produced on a printer (or copier) can be determined by how the printed material is distributed on the paper. The longer the cartridge lasts, the worse the print quality: streaks appear or letters are not printed.

In practice, it is almost impossible to conduct such a study. The difficulty is that, firstly, you need print samples made at different times. Secondly, there is no guarantee that these samples were printed on the same printer and the cartridge was not changed. And thirdly, using the same cartridge, you can print a document in different ways. Simply pull out the cartridge, shake it and put it back. And the print will be different.

There are situations when you need to produce a document on a typewriter. Experts believe that it is impossible to determine the age of a document based on the composition of the coloring material contained on the machine tape. But in terms of abrasion of printed elements, it is possible. The longer the machine runs, the more the letters wear out. By their imprint on the paper you can tell when the text was written. But for this we need samples of printing on this machine from previous years.

Well, now let’s talk about drawing up “fake” papers that will allow you to reduce payments to the budget. Accountants who prepare documents on behalf of fictitious firms should be aware that handwritten entries can be used by experts to determine who wrote them. “It happens that one signature is enough,” says Stanislav Shapovalov. – Of course, if it is made in the form of some kind of squiggle, I would not make a categorical conclusion. But some handwriting experts do. There's a lot of subjective stuff here. Even copies of documents are suitable for handwriting examination. The main thing is that they are not completely “blind”. First, a handwriting expert will determine whether there are signs of technical forgery of the document, or, more simply, whether the signature was inserted using a photocopier. If everything is in order with this, then there are no grounds for refusing the examination.”

Example 1

Entrepreneur Babushkin included expenses for the purchase of fish products as expenses. To confirm their payment, he presented the tax authorities with invoices and receipts for receipt orders. Having established that the suppliers of fish products were not registered with the tax authorities, the inspectors sent invoices and receipts for examination. Experts determined that the handwritten text in the documents was written by the entrepreneur himself.

The arbitration court, at the request of the inspectorate, fined Babushkin for deliberate underpayment of taxes (Part 3 of Article 122 of the Tax Code of the Russian Federation), and also collected arrears and penalties from him (resolution of the Federal Arbitration Court of the East Siberian District dated April 29, 2003 No. A74-2210/ 02-K2-F02-1126/ 03-S1).

This example is the exception rather than the rule. As practice shows, tax authorities do not often resort to the help of experts. “Tax inspectors rarely contact our bureau (once or twice a year), as a rule, when there is really something to fight for: large amounts of tax arrears and reasonable suspicions that the documents are fake,” said Stanislav Shapovalov.

Most often, tax authorities, suspecting something is wrong, simply do not recognize the company’s expenses with all the ensuing consequences: fines, collection of arrears and penalties. Although, according to the Civil Code, they must first go to court with a demand to declare the transaction based on forged documents invalid.

If a company does not want to pay a fine and goes to court, inspectors, as a rule, refer to the fact that the company’s suppliers are not registered for tax purposes, do not “reside” at the address indicated in the documents, and are not registered as legal entities at all. However, this does not prove that the company knew about the supplier’s deception or deliberately falsified documents in order to reduce taxes. If you insist that the papers were received from a real enterprise and you did not know that it did not have state registration, it will be difficult for inspectors to convince judges otherwise.

Most arbitrators in such a situation make decisions that are positive for the company (rulings of the federal arbitration courts of the Ural District dated January 14, 2003 No. F09-2842/02AK, Moscow District dated March 6, 2003 No. KA-A41/974-03, Central District dated May 16, 2003 No. A14-9037-02/290/24).

But there are also exceptions.

Example 2

During the inspection of the MUP “Confectionery Shop”, tax authorities found that the suppliers and LLC “Trading House “Khlebny”” are not registered with the tax authorities, have a fictitious TIN and are not registered as legal entities.The controllers assessed the company for VAT, income tax, penalties and fined it under paragraph 1 of Article 122 of the Tax Code. Disagreeing with this, the company went to court.

The judges declared transactions with unregistered suppliers invalid and on this basis rejected the claim (resolution of the Federal Arbitration Court of the Ural District dated May 7, 2003 No. F09-1227/03-AK).

In this example, the arbitrators did not bother to find out at all whether the Confectionery Shop knew that its suppliers did not have state registration or not. This means that the guilt of the enterprise was not established. This contradicts paragraph 6 of Article 108 and Article 109 of the Tax Code. A company or entrepreneur cannot be brought to tax liability if they are not to blame (Article 109 of the Tax Code of the Russian Federation). It is the tax authorities' responsibility to convince judges otherwise. Until guilt is proven, the company is considered innocent. Do not forget that all doubts about the guilt of the enterprise should be interpreted in its favor (clause 6 of Article 108 of the Tax Code of the Russian Federation).

Document form

As follows from the norm of paragraph 2 of Article 9 of Law No. 129-FZ, primary accounting documents must be compiled according to unified forms, and in the absence of specially developed unified forms - in any form in compliance with the necessary requirements.

Of course, all taxpayers must comply with the requirements of Russian legislation, but what to do if, for one reason or another, the documents received by the taxpayer from their executors do not meet these requirements? Such situations occur in the activities of business entities much more often than we would all like. Is it really true that due to formal violations in the preparation of primary accounting documents, the taxpayer should be deprived of the right to include the corresponding costs in the expenses taken into account when calculating income tax?

A very serious argument in favor of taxpayers are the provisions of paragraph 7 of PBU 1/98, approved by Order of the Ministry of Finance of Russia dated December 9, 1998 No. 60n, which indicates that when maintaining accounting records, the principle of priority of the content of a document over its form must be implemented. It is this point of view that is predominant in law enforcement practice.

When considering case No. A56-21172/03, the Federal Antimonopoly Service of the North-Western District took a very loyal approach to resolving the issue of improper execution of primary accounting documents. In this case, the taxpayer included the costs of carrying out major repairs as expenses that reduce taxable profit. The tax inspectorate considered the reduction of taxable profit to be unlawful, since the acceptance certificate for the work performed was drawn up in a free form that does not correspond to the unified form KS-2. In its ruling dated May 27, 2004, the court indicated that the failure of the work acceptance certificate to comply with the established form cannot be qualified as a lack of documentary evidence of costs incurred. The court assessed the documents presented to justify the expenses incurred (contract, terms of reference, protocol for agreeing on the contract price, certificate of cost of work in the KS-3 form, payment documents for payment for work), in their entirety, and concluded that they were legally taken into account when determining taxable profit.

When considering another case*, the Federal Antimonopoly Service of the North-Western District recognized as lawful the actions of the taxpayer, who included in the costs the costs of paying for the travel of employees on business trips and back by non-urban bus.

Note:

* Resolution of the Federal Antimonopoly Service of the North-Western District dated May 12, 2003 in case No. A52/2874/2002/2.

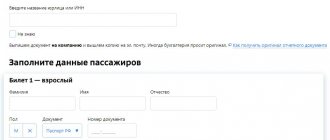

The arbitration court indicated that the albums of unified forms of primary accounting documentation do not establish the form of travel tickets, but the travel tickets presented by the taxpayer contain all the necessary details provided for in Article 9 of Law No. 129-FZ. Thus, there are no grounds for refusing to accept tickets that do not comply with a certain form as evidence of expenses incurred, if they contain all the necessary details.

Primary accounting documents

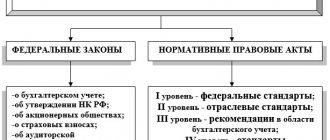

From Art. 313 of the Tax Code of the Russian Federation it follows that the basis for maintaining tax accounting are primary accounting documents (including an accountant’s certificate) (see also letter of the Ministry of Finance of Russia dated June 28, 2013 N 03-03-06/1/24663).

Thus, we believe that the basis for recognizing expenses under a transport expedition agreement, first of all, is the primary accounting document confirming the provision of these services (additionally, see letter of the Ministry of Finance of Russia dated December 14, 2011 N 03-03-06/1/ 824).

Currently, the forms of primary accounting documents necessary for registration of certain facts of economic life are determined by the head of the economic entity on the recommendation of the official who is entrusted with maintaining accounting records (Part 4 of Article 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ), information of the Ministry of Finance of Russia dated December 4, 2012 No. PZ-10/2012). Mandatory details of primary accounting documents are listed in Part 2 of Art. 9 of Law No. 402-FZ.

Based on the foregoing, we can conclude that the fact of provision of services under a transport expedition agreement can be confirmed by any document that meets the requirements of Part 2 of Art. 9 of Law N 402-FZ, approved for this purpose, for example, by act.

Errors in primary documents

Organizations often make mistakes when filling out primary accounting documents. With a formal approach, this may serve as a basis for not accepting documents as supporting evidence. However, as the Federal Antimonopoly Service of the North-Western District indicated in its resolution dated May 12, 2005 in case No. A05-6965/04-10, an erroneous indication of the date in the invoice and invoice cannot serve as a basis for not accepting the taxpayer’s expenses when establishing the fact of expenses incurred and their production nature , economic feasibility and documentary evidence.

That the coming year?

Federal Law No. 58-FZ dated June 6, 2005 (read the commentary on the law here) amended paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

In accordance with these changes, from January 1, 2006, documented expenses will be understood as expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in a foreign country in whose territory the corresponding transactions were made expenses, and (or) documents indirectly confirming expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

Thus, I really want to believe that starting next year taxpayers will have one less problem. As documents confirming expenses incurred, not only primary accounting documents drawn up in accordance with the requirements of Law No. 129-FZ, but also other documents indirectly confirming expenses incurred will have to be accepted. It should be noted that the list of such documents given in brackets in paragraph 1 of Article 252 of the Code is open.

As for disputes with tax authorities regarding expenses incurred before January 1, 2006, taxpayers should use the provisions of paragraph 6 of Article 108 of the Tax Code of the Russian Federation to prove their case and, in addition to primary accounting documents, provide the tax authorities (and, if necessary, judicial authorities) with other documents , directly or indirectly confirming the expenses incurred.