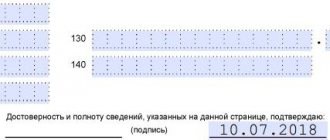

Dates of receipt of income and withholding of personal income tax In contrast to wages, the day of actual receipt of income

Training according to the professional standard of an accountant The professional standard “Accountant” acts as a characteristic of the qualifications required by a specialist

In the Russian Federation, every year before April 15, legal entities need to confirm their main type of activity.

In November 2011, the provisions of Federal Law dated November 21, 2011 No. 330-FZ came into force

To calculate sick leave benefits for a highly paid employee, you need to know the maximum average daily earnings in

In the recommendation: – what is an electronic invoice (ESF); – when it is not necessary to issue an ESF; –

Preparation for the formation of balance sheet indicators The construction of an enterprise’s balance sheet is carried out on the basis of accounting data,

The need for separate accounting The tax base for the sale of excisable goods is determined separately for each of them

2021-05-28 1850 One of the stable sources of replenishing the country’s budget is the personal income tax

Kira Gin, managing partner of the law, has prepared a small instruction on how to get through without financial