Procedure for calculating VAT during construction and installation work To calculate VAT when performing construction and installation work for your own

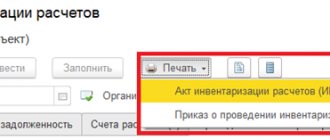

In the process of economic activity of each organization, the need may arise to recover funds from its

How is downtime due to the employer’s fault paid? To calculate insurance premiums, it is very important to correctly classify

The other day it became known that Rostrud finally approved 107 checklists. From January 1

Selecting a bonus code Employers pay bonuses to employees based on their own local regulations. Cause

What should be in the VAT accounting policy The VAT accounting policy may include:

Write-off of receivables can be of two types: taken into account for tax purposes and not taken into account. So

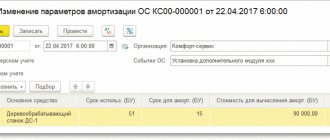

Modernization of a fixed asset 1C BGU 8.2 Modernization is a change in the value of a fixed asset from

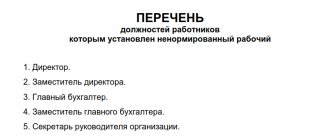

This is the answer to the frequent question: irregular working hours - what is it? Ask

At the moment when you register as an individual entrepreneur, you need to understand that now