For individual entrepreneurs using PSNO, the object of taxation is potentially receivable

December 4, 2019 Terms Elena Erokhina Payment is provided for the performance of a number of functions by government bodies.

Accounting for third party services Third party services are a type of activity that is not

Expenses to combat coronavirus This is a new type of expense that appeared in 2021.

Companies can sell goods either independently, on their own, or by involving intermediaries. This is enough

I remember that in Soviet times people lived with the idea that if they were honest and

If an organization carries out any actions with cash, it is obliged to register them in accounting

When filling out the 2nd personal income tax declaration, the accountant does not understand how to reflect travel and daily allowances

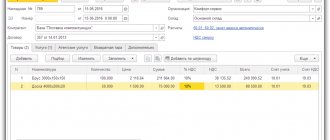

How to create a new entry in the purchase book in the 1C 8.3 accounting program? Education processes

EXPLANATORY NOTE (FOR MOSCOW) Help Print version. Staffing number number of employees