Calculation of vacation pay in 2021. 5 mistakes to avoid Mistakes when calculating vacation pay

Every company and every individual entrepreneur who uses cash registers for settlement transactions with clients,

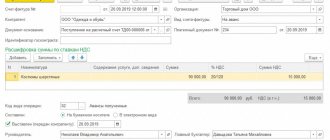

Deduction of VAT from the seller upon receipt of an advance payment In accordance with the terms of the concluded agreement, the buyer

What kind of report? Previously, you submitted RSV-1 and 4-FSS reports to the pension fund and

Let's consider the features of reflecting in 1C received materials intended for operations not subject to VAT. For example

Program "Declaration 2012" for filling out 3-NDFL for 2012 Program "Declaration 2012", version 1.2.0

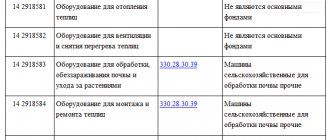

Property value limit in 2021 Until January 1, 2021, the residual value of fixed assets

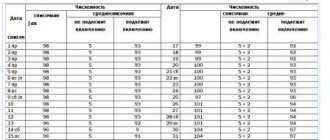

The country's tax legislation establishes the obligation of all employers to annually report on the average number of personnel employed

A number of professions are closely related to the need for employees to perform their labor functions out of place

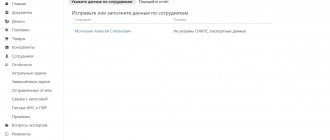

Filling out 6-NDFL when changing tax residence Tax residents are individuals who are not actually located in the Russian Federation