Basics of calculation and payment of the simplified tax system To calculate the simplified tax, the Tax Code of the Russian Federation establishes two types

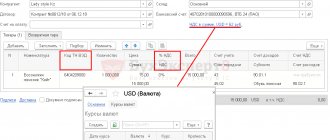

+ VAT submitted In accordance with paragraph 3 of the Protocol on the procedure for collecting indirect taxes

Taxes 02/09/2021 85075 Author: Igor Smirnov Photo: pixabay.com Standard tax deductions are the amount

The organization (general taxation regime) manufactures various electronic devices. In accordance with the terms of the supply agreement

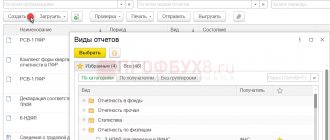

Creating a new 6-NDFL report and filling out the title page To create a 6-NDFL, open 1C: Reporting

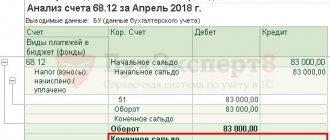

Fiscal relationships with departments responsible for taxation are an important aspect in the life of any

What kind of preferences were offered to small businesses this year so that they survive and

Article 213 of the Labor Code of the Russian Federation: medical examinations. The Theory of Everything This page presents article 213

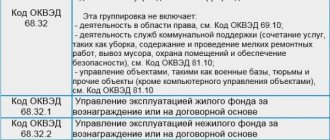

OKVED: what it contains and where it is applied OKVED (All-Russian Classifier of Types of Economic Activities) contains codes

What legal acts regulate payment for work on days off? Issues of remuneration, as on working days