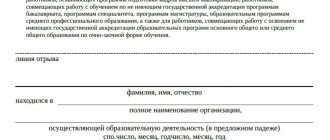

Call-up certificate for session 2021: who needs it and why The call-up certificate form was approved on December 19, 2013

The definition of a tax return is given in Article 80 of the Tax Code of the Russian Federation. This is a document drawn up in accordance with

What is an electronic sheet Despite the fact that the scope of use of the new document is growing,

The headcount of employees is a type of reporting in which the head of the enterprise himself is interested.

Who must submit the 6-NDFL report and when? The 6-NDFL report is submitted every quarter and

If for some reason you do not want to continue your entrepreneurial activity, then the right decision would be

Appointment of the General Director The only body authorized to appoint a person to the specified position is the general meeting

Who can be blocked? Everyone who has a bank account and

In 2021, insurers will submit calculations in Form 4-FSS for contributions for “injuries” to

When paying taxes, a citizen may overpay. The excess amount is reflected in your personal account