What changes in Russian legislation have occurred since October 1, 2021? Which of them

What to consider when reflecting indirect expenses in the accounting policy Such requirements are contained in the legislation

Information on income tax is reflected by tax agents in 2-NDFL certificates and 6-NDFL calculations. These

Changes in accounting for fixed assets in 2021 are associated with the introduction of a new All-Russian classifier

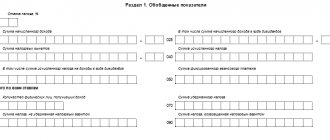

Reliability.. This is a sheet with summary information, which is filled out last, when the

Two news - good and bad. The good news is that, as a rule, Russian

Author: Ivan Ivanov Vacation time reflected in the time sheet does not always involve the same means of designation. Order

Accounting policy for LLC under UTII Accounting policy “Impostors” of the organization are required to keep accounting, and

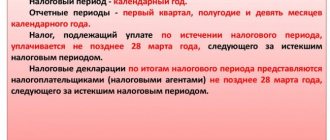

A company can make tax advances either quarterly or monthly. The specific order depends on:

The Russian Ministry of Finance issued Order No. 35n of the Ministry of Finance dated February 28, 2018. It was officially published on April 23