The dismissal of an employee must always be carried out according to the law, regardless of the reasons and circumstances of his departure.

For tax purposes, the Tax Code of the Russian Federation understands the concept of “income” as income received by a person both in

There are several classifications according to which codes are assigned to entrepreneurs and companies. From 2021 they

The “Debt Adjustment” document is located in the “Regulations” section panel. . Debt adjustment can be carried out by

Question No. 1 Sometimes, when sending an employee on a business trip, atypical situations arise. What regulatory

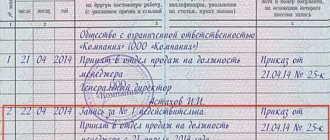

A work book is no less valuable a document than a passport, birth certificate,

The formation of a balance sheet for account 70 in the accounting of an organization makes it possible to quickly monitor:

Changes It is no secret that the rates of contributions to state social funds are the second highest

Cash transaction accountants sometimes wonder whether errors are allowed,

Characteristics of account 02 In the company's accounting, all operations of financial and economic activities are carried out on the appropriate accounts.