How to calculate the simplified tax system for individual entrepreneurs - with simplified taxation, the tax period is considered to be a calendar year, and

Introduction The development of the world economy has led to a variety of sources, forms and conditions for attracting borrowed capital.

The organization during the construction of several objects, which after completion of construction will be rented out, combines

Legal topics are very complex, but in this article we will try to answer the question “System

KUDIR is a book of income and expenses that must be maintained by all organizations and

Transactions with non-residential premises - shops, offices, garages, basements - are in demand on the market

Covering letter for the updated VAT tax return for the __ quarter of 20__. IN

array(49) { ["ID"]=> string(5) "35728" ["~ID"]=> string(5) "35728" ["NAME"]=> string(88) "How to fill out section 2

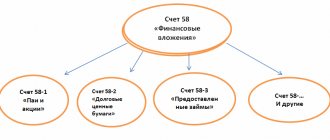

Types of securities According to Art. 142 of the Civil Code of the Russian Federation, a security is a document certifying

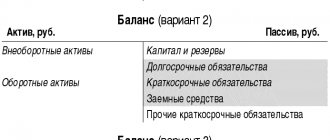

The concept of fixed capital In general, capital means financial resources invested by an enterprise in its own assets