Income tax under a leasing agreement We save within the law: the pitfalls of leasing. Navigation

What is the tax regime Business pays taxes according to certain rules and formulas. Simply put,

Reflection in accounting of the results of inventory of fixed assets If, based on the results of the inventory, unaccounted for

All PBUs for accounting in 2021: list This article summarizes all PBUs

Let's study how to correctly reflect VAT for deduction upon receipt of goods and materials in 1C 8.2

General characteristics of corporate income tax Corporate income tax is a direct federal tax,

Fulfillment of contractual obligations does not always require 100% prepayment before delivery of goods or services. Usually

Legal regulation of wage payments The Labor Code of the Russian Federation regulates the legal aspects of wage payments. In the chapter

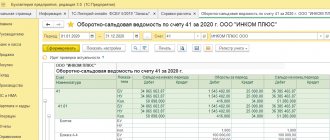

In the 1C Accounting 8.3 program, the calculation of income tax and tax under the simplified tax system is automated

Calculation of average earnings What formula is used to calculate SZ depends on whether the employee is fully