ATTENTION! Wage indexation in 2021 in commercial organizations Inflation is a process

Currency control during the implementation of an export project: minimizing risks Transcript of M. K. Antipov’s speech at

Income tax in NPOs NPOs, like any legal entity on OSNO, pays

Reasons for the occurrence of debts As a result of mutual settlements with employees, the organization may arise as a debt to

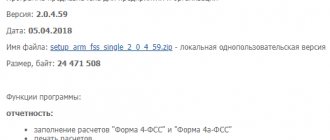

An interim report is a regular report in Form 4-FSS; it is filled out when the insured businessman has made

Subsection 3.2 (3.2.1 - lines 190-250 and 3.2.2 - lines 260-300) All other sheets

Do you need a seal? There is nothing in the legislation about putting a stamp on this type of check.

The Ministry of Finance has clarified the nuances of difficulties with payment documents this year. From whether it is correct

There is no clear formulation of the sales receipt in the specialized literature. However, it is legally valid

When an employee is entitled to compensation for the use of a personal car Regulations for the calculation and accrual of compensation for